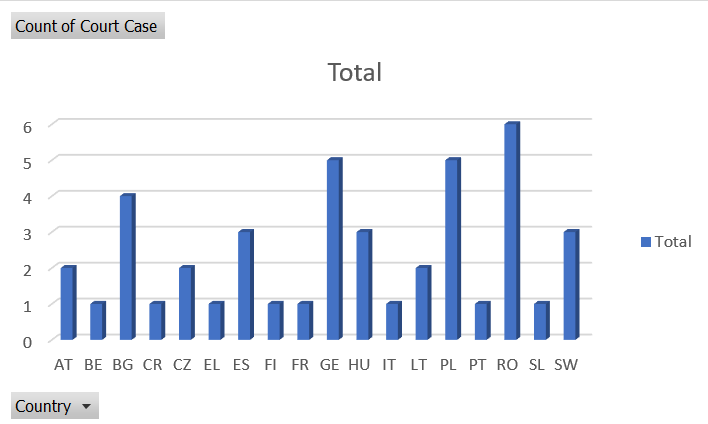

- In 2024 so far, 43 cases have been initiated compared to 32 in 2023 and 46 cases in 2022

- Romania, once again, has raised most of the cases 6

- 18 EU Member States raised at least 1 ECJ case

Austria

Belgium

Bulgaria

Croatia

Czech Republic

Greece

Spain

Finland

France

Germany

Hungary

Italy

Lithunia

Poland

Portugal

Romania

- T-643/24 Credidam

- C-570/24 Ecoserv

- C-475/24 Fashion TV RO and Maestro

- C-392/24 PPC Renewables Romania

- C-261/24 Alizeu Eolian

- C-251/24 Axpo Energy Romania

Slovenia

Sweden

- T-558/24 Studieförbundet Vuxenskolan Riksorganisationen

- C-436/24 Lyko Operations

- C-125/24 Palmstråle

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- Comments on ECJ C-796/23: Consideration of Czech company for VAT purposes as ‘designated partner’ in violation of EU law

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights