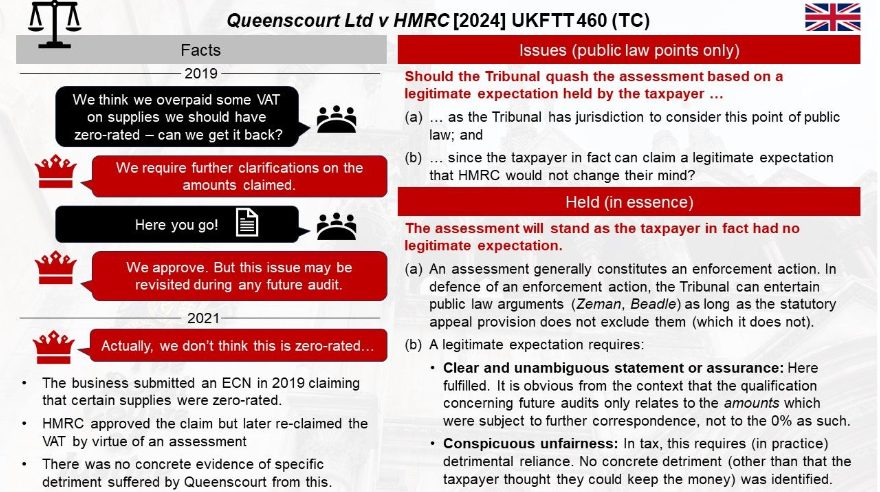

If tax authorities initially approve a tax refund claim but later change their decision, it may seem unfair. However, in legal proceedings based on a legitimate expectation, this alone is not enough. While there is occasional mention of the idea that “detrimental reliance” by the taxpayer is not strictly necessary, in practice it often is. This was evident in a court case and is generally the approach taken by the law. Businesses must be prepared for unexpected changes until the time limits for claims expire.

Source Fabian Barth

Latest Posts in "United Kingdom"

- UK Eases VAT Grouping Rules to Attract Foreign Investment and Simplify Cross-Border Compliance

- Tribunal Rules Bespoke Autobiography Books by Story Terrace Qualify for VAT Zero-Rating

- Full VAT Recovery Allowed on Product Photography Costs in Littlewoods v HMRC Tribunal Decision

- FTT Favors Commercial Reality Over Contract in VAT Reclaim Case on Truck Fuel and Repairs

- HMRC Updates VAT Exemption for Temporary Medical Staff After Isle of Wight Tribunal Decision