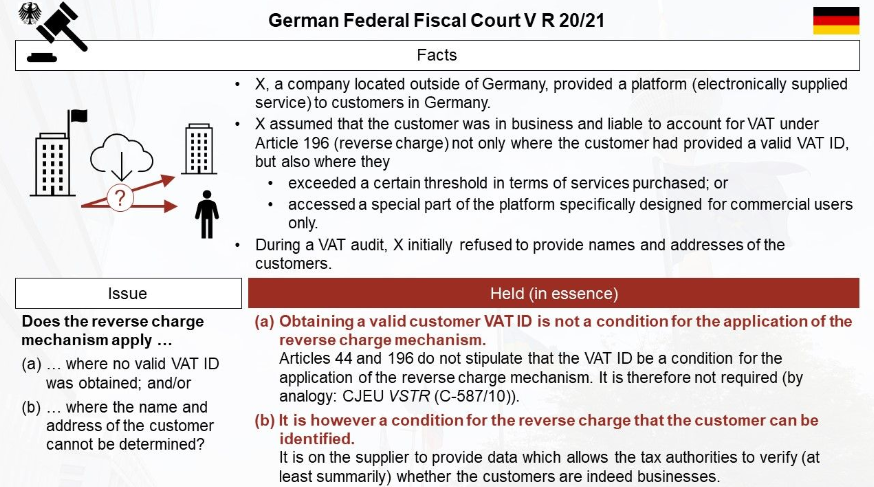

The German Tax Authorities have been overly enthusiastic about the Quick Fixes, treating the VAT ID as a substantive requirement even in the context of services. However, the Federal Court has now rejected this requirement. While customer identification is necessary, it is difficult to reconcile with EU law that it is the sole determinant of whether a supply is B2B. The true purpose of customer identification seems to be to facilitate the tax authorities’ task of compelling customers to comply with reverse charge obligations, which is not the supplier’s burden according to the law.

Source Fabian Barth

Latest Posts in "Germany"

- BFH Clarifies VAT Rules for Single- and Multi-Purpose Vouchers After ECJ Ruling

- Germany Updates E-Invoicing FAQ: New Clarifications on Transmission and Compliance for 2025

- Comprehensive VAT Guide – Germany (2026)

- ecosio Webinar: 8 Key considerations for Germany’s E-Invoicing Mandate

- End of Cuxhaven Free Zone and Updates to Customs and Energy Tax Penalties in Germany