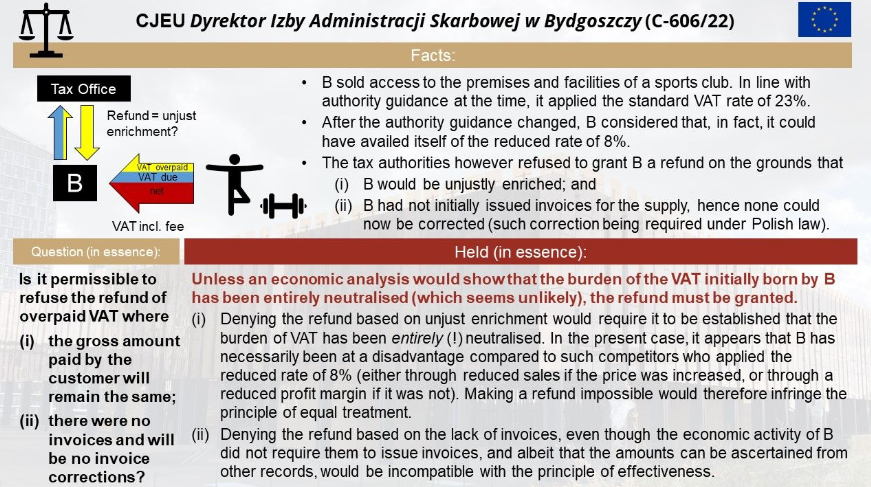

- Tax authorities can deny a refund of overpaid VAT on the ground of unjust enrichment.

- Under EU law, the issue is complex and has been misunderstood by tax officers, legal advisors, and courts.

- However, it has been authoritatively stated that unjust enrichment in a B2C scenario is virtually impossible.

- This is because the supplier will always suffer, either by losing sales if they increase prices to account for higher VAT, or by losing profits if they cannot increase prices.

- The only exception is if all suppliers of a product with inelastic demand make the same mistake, which is very rare in practice.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- ECJ State Aid C-360/25 (X) – Questions – Does the exemption under art. 135(1)(d) of the VAT Directive constitute State Aid?

- EU and Indonesia conclude negotiations on free trade agreement

- ECJ Case: VAT Treatment of Loyalty Points vs Vouchers Under EU Directive

- FISC Hearing on Tax Implications of Trump Administration Policies September 23

- VAT Rules for Virtual Game Currencies: EU Court Advocate General Opinion