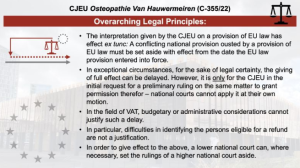

Where EU law rights are fiscally inconvenient, Member States may sometimes try to delay their implementation. In particular, they might attempt to refuse refunds of unduly charged VAT, to their own enrichment and the detriment of businesses. Gladly, the Court shows little mercy with such attempts. This is not generous, but plainly necessary: Had it been otherwise, Member States might impose taxes in breach of EU law, knowing full well that they can get away with it for a few years before being challenged.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- EU to Scrap €150 Customs Exemption by 2028, Introduce €2 Levy in 2026

- EU Abolishes €150 Customs Threshold to Curb Small Parcel Influx and Ensure Fair Competition

- ViDA Implementation Strategy: Preparing Industry for VAT Reform in the Digital Age

- EU to Remove €150 Customs Duty Exemption for E-Commerce Parcels from 2026

- Roadtrip through ECJ Cases – Focus on the Exemption for Intra-Community supplies of goods (Art. 138)