This revision should align with EU criteria and may include allowing taxpayers to choose the taxable status for certain operations. However, it’s important to note that EU principles require a narrow interpretation of exemptions, and any changes must adhere to these principles. The law particularly emphasizes the possible revision of rules concerning the real estate sector. While the law allows for potential changes, it must remain in line with EU regulations, which require a strict approach to exemptions.

Source: eutekne.info

Latest Posts in "Italy"

- VAT Exemption Also Applies to Claims Management Services, Rules Italian Supreme Court

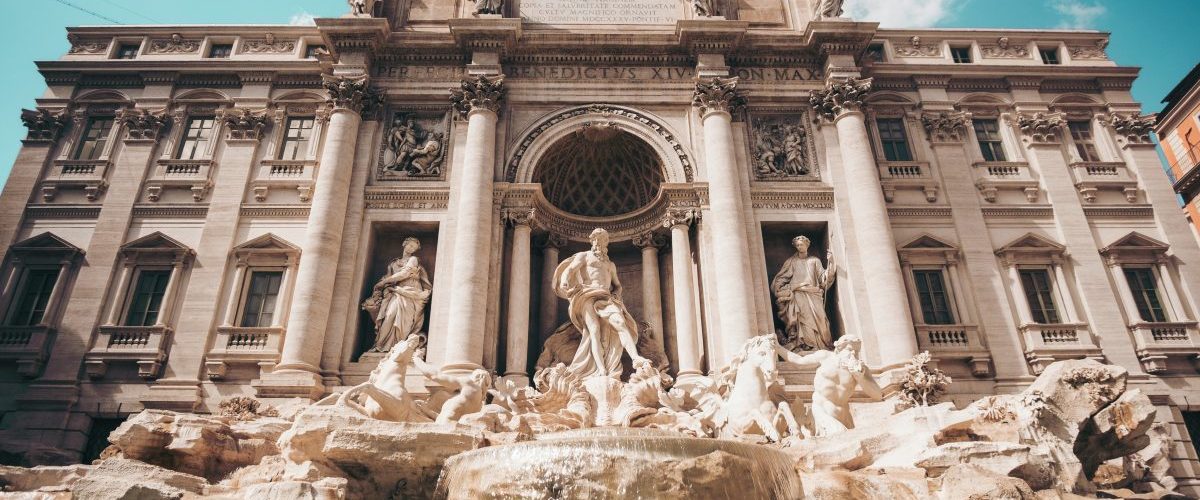

- Italy Proposes Rome as Host City for New EU Customs Authority Headquarters

- Rome Proposes to Host New EU Customs Authority, Highlighting Strategic and Historical Significance

- €78 Million VAT Fraud Uncovered in EU: ‘Nebula’ Investigation Exposes Cross-Border Tax Evasion

- VAT on Prepaid Fuel Cards: When Is It Charged—At Purchase or Refueling?