What is the standard VAT rate?

The standard VAT rate is the default rate of Value Added Tax (VAT) that is applied to most goods and services in a particular country.

What is the effective VAT rate?

The effective rate is the ratio of the VTTL (VAT Total Tax Liability) and the tax base.

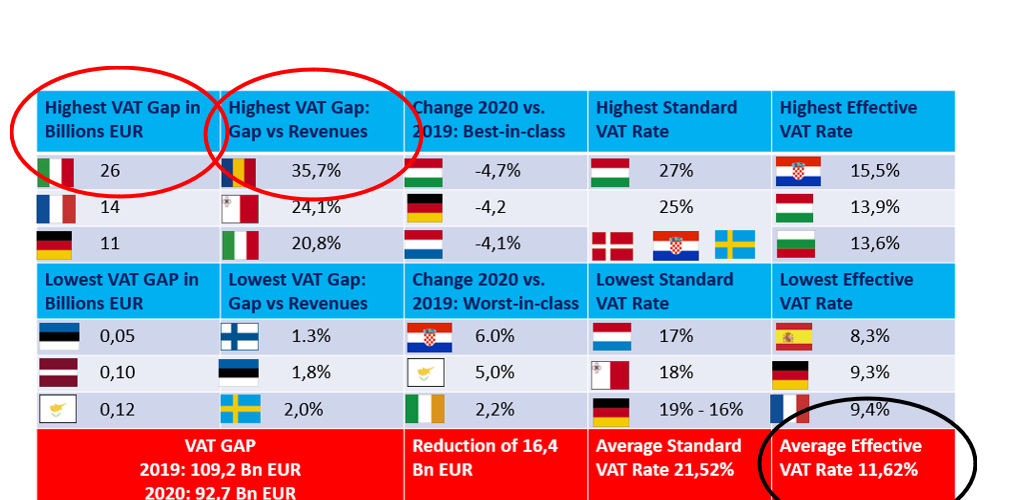

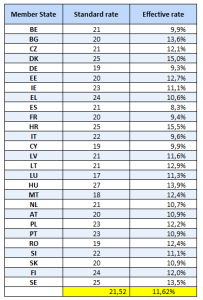

In 2020, the average standard VAT rate in the European Union was 21, 52%, while the effective rate is 11, 62%. The difference is due amongst other to the reduced VAT rates and exemptions for certain goods and services.

Source VAT Gap: EU countries lost €93 billion in VAT revenues in 2020

Latest Posts in "European Union"

- VAT Applies to Retailer’s Tax-Free Refund Processing Fees: No Exemption, Fee Treated as Gross Price

- CJEU Confirms Triangulation VAT Relief Applies to Four-Party Chains, Even with Direct Customer Delivery

- Is User Data a Form of Payment? EU VAT Committee Explores Taxation of Digital Barter Transactions

- HMRC Reverses VAT Grouping Policy on EU Branches, Allowing UK Businesses to Reclaim Overpaid VAT

- CJEU Broadens VAT Exemption for Negotiation Services in Mortgage Intermediation Cases