See also

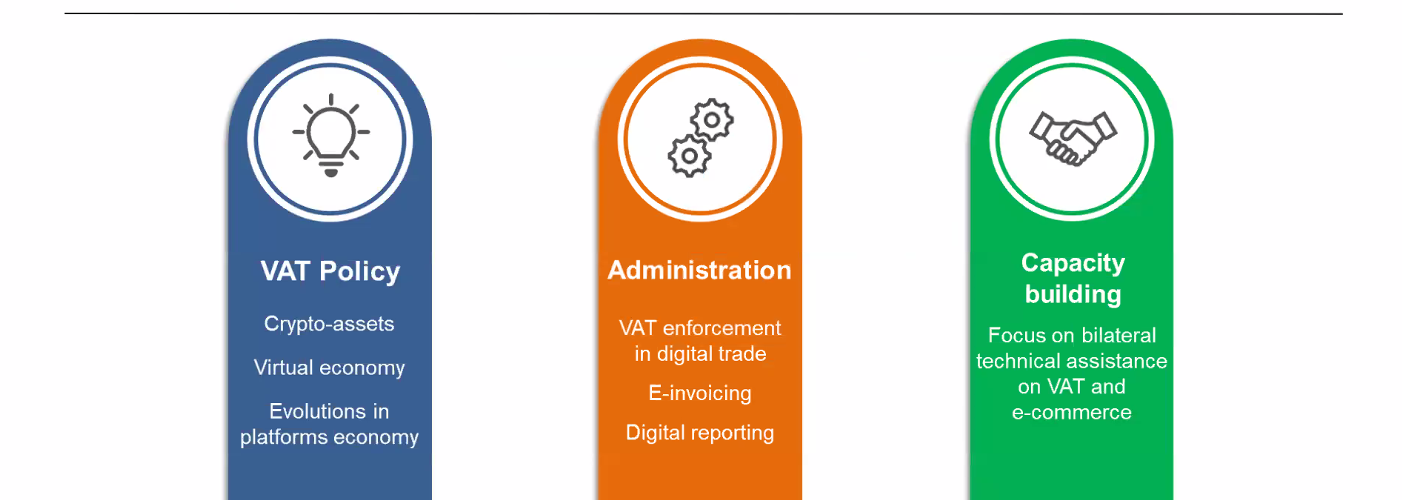

- OECD: The Role of Digital Platforms in the Collection of VAT/GST on Online Sales

- OECD International VAT/GST Guidelines

See also

- VAT Digital Toolkit for Latin America and the Caribbean

- VAT Digital Toolkit for Asia-Pacific

- VAT Digital Toolkit for Africa

\

\

See also

- OECD Forum on Tax Administration – Tax Administration 3.0 and Electronic Invoicing – Initial Findings

- OECD releases cryptoasset reporting framework and CRS amendments

Source

Latest Posts in "World"

- OECD Issues Guidance on Digital Continuous Transactional Reporting Regimes for VAT Compliance and Administration

- VATupdate Newsletter Week 2 2026

- Fintua’s International VAT Rate Round Up: December 2025

- E-Invoicing & E-Reporting developments in the news in week 2/2026

- OECD Guidance for Effective and Interoperable VAT E-Invoicing and E-Reporting Regimes