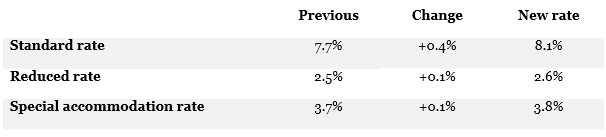

To cover an expected deficit in the AHV state pension scheme, Swiss VAT rates will increase as follows:

The increase in VAT rates will take effect on 1 January 2024. We expect the FTA to publish guidance on its website before the new VAT rates come into force, explaining how the new rates are to be applied to supplies and invoices spanning the changeover period.

Source Mihaela Merz

Latest Posts in "Switzerland"

- VAT Refund Procedure: Updated Requirements for Foreign Tax Authority Entrepreneur Certification (as of 26.02.2026)

- VAT: Updated Certification Requirements for Foreign Entrepreneurs in Refund Procedures (as of Feb 26, 2026)

- Customs Exemption Denied: Rocket Research Donation Not Deemed to Alleviate Need or Damage

- New VAT Exemption Eases Collaboration for Outpatient Clinics and Day Hospitals in Healthcare Sector

- Tax Implications of Notification Procedures for Different VAT Accounting Methods in Switzerland