This report is the culmination of conversations with many businesses and clients, extensive research via completed questionnaires, meetings, and workshops. Each of the different methods of engagement have held one common thread: ideas being shared by people who are passionate about the VAT regime and want to see it more effectively meet the needs of all stakeholders and wider society to build a better future.

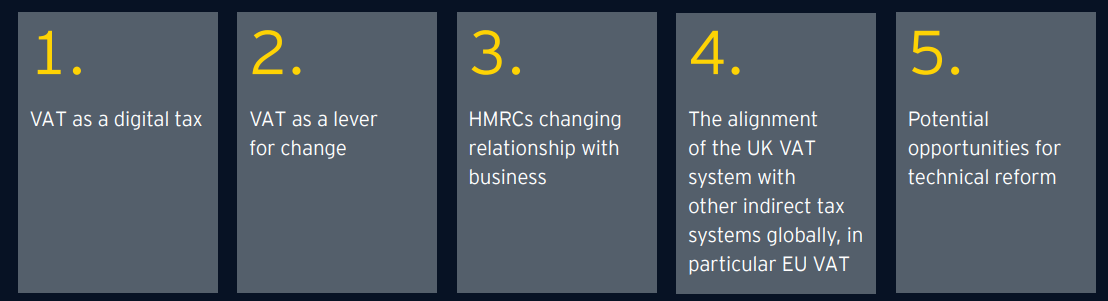

EY has conducted deep dives into some key areas:

Source EY

Latest Posts in "United Kingdom"

- HMRC Policy paper: Budget 2025 document

- Briefing document & Podcast: E-Invoicing & E-Reporting in the United Kingdom: Scope and Implementation Overview

- Mandatory B2B e-invoicing as of April 2029

- UK Budget 2025: HMRC Eases VAT Rules for UK Businesses with EU Branches

- Budget 2025: Government Bans VAT Loophole for Uber, Bolt and Ride-Hailing Apps