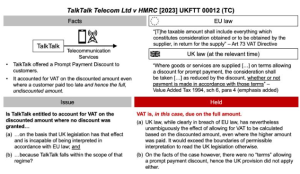

The judge found to be unambiguous the (now amended) provision allowing UK taxpayers to charge VAT on a discounted price even where the full price was received, and felt that it would exceed the boundaries of interpretation if it gave that provision an EU law-consistent meaning (which would in any case require VAT to be paid on the actual consideration received).

Source Fabian Barth

Latest Posts in "United Kingdom"

- UK Budget 2025: VAT E-Invoicing, Digital Compliance, and Post-Brexit Tax Reforms Announced

- FTT Rules HMRC Closure Notice Bars VAT Registration: Hairdresser’s Turnover Below Threshold, Appeal Allowed

- UK Tribunal Rules Self-Employed Hairdresser Not Liable for VAT Registration Under Rent-a-Chair Model

- EU Insists on VAT Representative for UK Firms Despite British Objections to Import Rules

- Mandatory B2B e-invoicing as of April 2029