The report provides information on Value Added Taxes/Goods and Services Taxes (VAT/GST) and excise duty rates in OECD member countries. It also contains information about international aspects of VAT/GST developments and the efficiency of this tax. It describes a range of other consumption taxation provisions on tobacco, alcoholic beverages, motor vehicles and aviation fuels.

Some learnings:

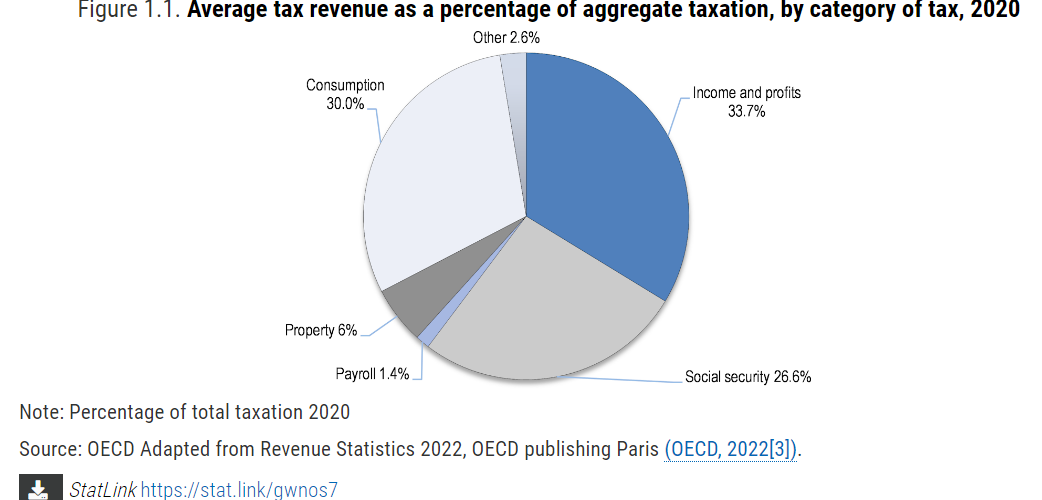

- Consumption taxes account for 30% of total tax revenue in OECD countries, on average

-

VAT remains the largest source of consumption tax revenues, by far

-

Taxes on specific goods and services now account for less than 10% of total taxes

-

VAT is the main consumption tax for countries around the world

-

VAT has now been implemented in 174 countries worldwide

-

Standard VAT rates remained stable in recent years

-

OECD countries continue to apply a wide variety of reduced rates mainly as a means to promote equity and/or to stimulate certain sectors

- ….

Source OECD

Latest Posts in "World"

- Zampa VAT Newsletter Q.4 2025

- Withholding VAT on Non-Resident Digital Services: Mechanisms, Compliance, and Global Approaches

- OECD Issues Guidance on Digital Continuous Transaction Reporting for VAT Compliance and Implementation

- Why E-invoices Get Rejected After Validation: 9 Essential Data Enrichments for Compliance

- Global VAT and Indirect Tax Rate Changes Effective in 2026: Key Updates by Jurisdiction