The new system, which will be enforced from April 1, 2023, will include changes to terminology, rules, and documentation requirements.

The use of tax invoices will be replaced by a more general requirement to provide and keep certain records known as ‘taxable supply information,’ and the customer will not be required to maintain a single physical document holding the taxable supply information, such as a tax invoice, credit note, and debit note.

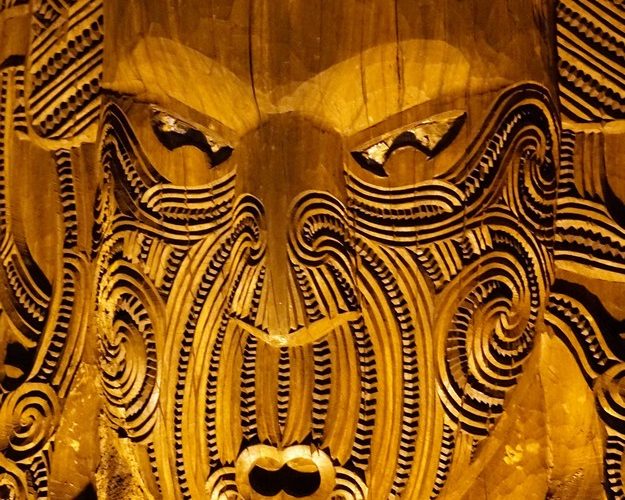

Source: indiannewslink.co.nz

Latest Posts in "New Zealand"

- Commissioner’s View on GST Taxable Activity Definition and Legal Interpretation

- New Zealand’s e-Invoicing Mandate: Transition, Compliance, and Benefits for Businesses and Government

- GST Ruling: Accommodation Supply in Commercial Dwelling and Input Tax Deductions Eligibility

- New Zealand Customs Updates GST Refund Process for Importers and Extends Application Period

- New Zealand Mandates E-Invoicing for Public Agencies by 2026 to Enhance Efficiency and Transparency