Unfortunately, for many companies, indirect tax requirements are often an afterthought in their transformation efforts and processes, leaving companies to find patchwork solutions to ensure they remain compliant. This not only raises the risk of non-compliance, but can also be a more expensive way of operating.

Here are some key areas where it is important be proactive and get ahead of the changes coming into force.

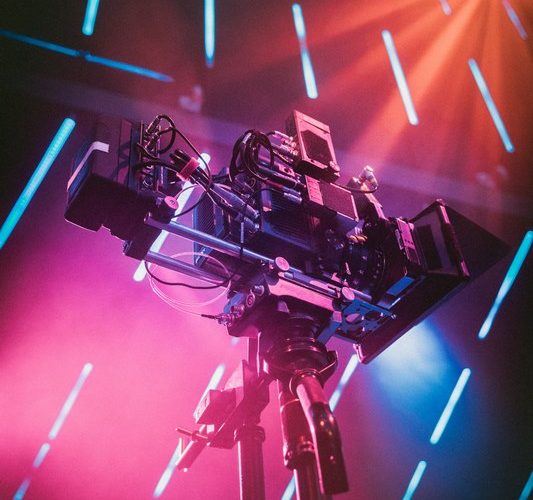

Source: Vertex

Latest Posts in "World"

- Recent ECJ/General Court VAT Jurisprudence and Implications for EU Compliance (November 2025)

- Release notes for Peppol BIS Billing v3

- E-Invoicing & E-Reporting developments in the news in week 48/2025

- Country Profiles on E-Invoicing, E-Reporting, E-Transport, SAF-T Mandates, and ViDA Initiatives

- VAT & Sales Tax Updates: November 2025