We are extremely proud that in this episode of VAT Talks we spoke with one of the fathers of the first real-time reporting system in the European Union, Rufino de la Rosa. After setting up the Suministro de Información Inmediata (SII), Rufino is now Partner Global Compliance and Reporting at EY. During the interview we discussed the main functionalities of the SII, why the Spanish tax authority decided to implement such a system and how the implementation process looked like. We also discussed how the tax authority is using the tool. Rufino explained that step by step the data collected is more often used for data analytics. In order to pre-fill VAT returns for example. Another hot topic on which Rufino shined his light is the upcoming e-invoicing legislation in Spain. Lastly, we discussed the upcoming plans of the European Commission regarding Transaction Based Reporting (TBR). Rufino could not be clearer when he stated: “Do it!”

Source: summitto.com

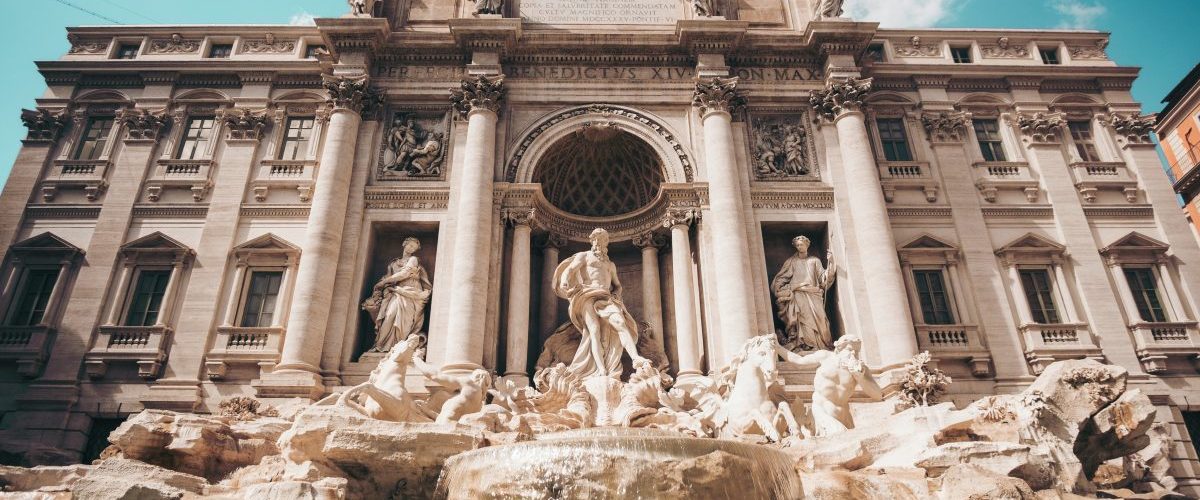

Latest Posts in "Italy"

- VAT Treatment for Solidarity Purchase Groups’ Collective Distribution to Members under 2026 Tax Reform

- Supreme Court Ruling on VAT Exemption for Insurance Brokerage Activities

- Naples Public Officials Convicted in Major Cross-Border VAT Fraud Case

- Italy: Officials, Tax Officer, and Accountant Convicted for Major VAT Fraud Scheme

- Italy: Four Convicted, Seven Plead Guilty in Major VAT Fraud Involving Public Officials