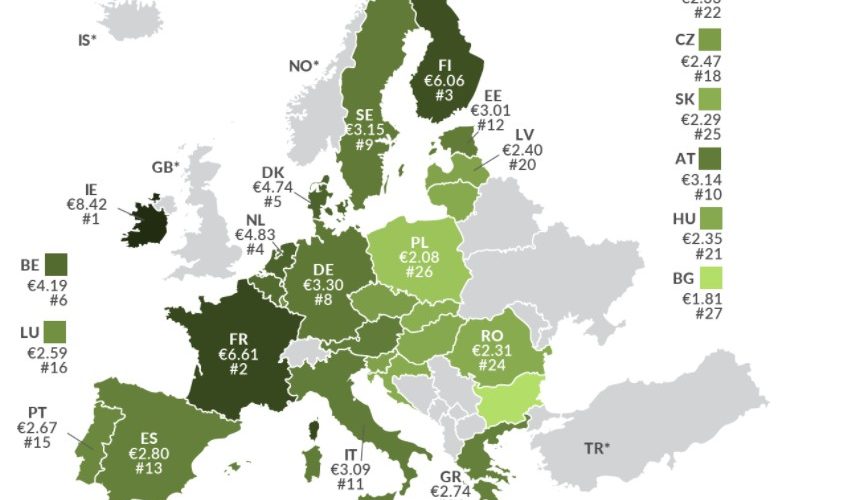

To ensure the functioning of its internal market, the European Union (EU) sets a minimum excise duty on cigarettes. It consists of a specific component and an ad valorem component, resulting in a minimum overall excise duty of €1.80 (US $2.05) per 20-cigarette pack and 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). As this map shows, most EU countries levy much higher excise duties on cigarettes than legally required.

Source

Latest Posts in "European Union"

- CEN Approves Revised EN 16931: A Milestone for ViDA Implementation

- Successful Implementation of VAT in the Digital Age (ViDA) Discussed with Commissioner Hoekstra

- General Court T-638/24 (D GmbH) – AG Opinion – VAT on Intra-Community Acquisitions Not Precluded by Errors

- Commission Backs Italy’s VAT Derogation on certain vehicles Through 2028

- Comments on GC T‑575/24 – AG – Contrary to EU law if services provided to members are regarded as internal acts