Greece’s VAT reform is set to become mandatory for all businesses in November 2021. The reform aims to give the government better visibility on financial data, increase efficiency and prevent fraud.

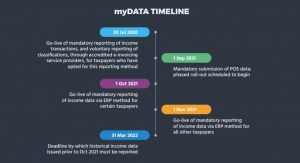

Starting 1 November 2021, taxpayers must report income data within the myDATA system, and provide historical data by 31 March 2022.

Sovos’ e-reporting solutions provide a summary of income and expense documents, classifications of recorded transactions and regular corrective accounting entries, making compliance with Greece’s new mandates simple.

Latest Posts in "Greece"

- Digital Delivery Notes – Extension of Phase B Implementation and New Exemptions

- RTC Webinar: CSE Countries – Implementing e-Invoicing and SAF-T Mandates (Nov 5)

- VAT IT eezi webinar – European E-Invoicing Spotlight: Greece, Poland, Croatia & Spain (Nov 27)

- Briefing Document & Podcast – Greece E‑Invoicing, E‑Reporting, and E‑Transport: Scope, Timeline & Requirements

- EPPO Arrests 37 in Greece Over €19.6 Million Agricultural Subsidy Fraud and Money Laundering