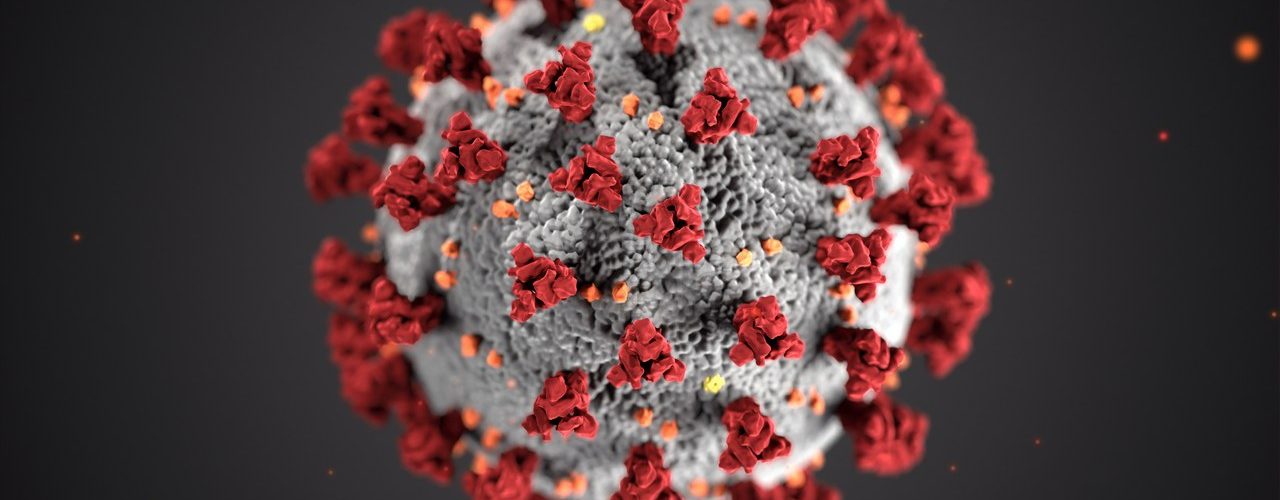

During the past months, since the break-out of COVID-19 in Europe, many countries in the European Union have taken temporary measures on the reduction of VAT rates or VAT exemptions. Some of these measures have elasped, some other have been extended or are still valid.

The overview is updated till Oct 25, 2020. ANy changes versus the prior issue of Sept 3, 2020, are highlighted in red.

In case, the overview misses a measure for your specific country, please let us know via [email protected].

Source www.vatupdate.com

Latest Posts in "European Union"

- Roadtrip through ECJ Cases – Focus on ”Place of supply of Goods – Chain Supplies” (Art. 32)

- EU Must Intensify Efforts Against Tax Fraud and Corruption, Says Chief Prosecutor

- Complex Interplay: Transfer Pricing and VAT Challenges for Multinational Corporations in the EU

- Complex Interplay: Transfer Pricing and VAT Challenges for Multinational Corporations in the EU

- German E-Commerce Group Achieves Multi-Country VAT Compliance Post-OSS Suspension with hellotax Support