- Administrative merger organizations in the Netherlands aim to support participating municipalities, especially smaller ones, by pooling resources.

- The Dutch Tax Authority considers these organizations as providing a single service, a view that is disputed and currently under legal review.

- The application of the VAT exemption (koepelvrijstelling) would save 21% VAT on personnel costs for these organizations.

- The Ministry of Finance argues that the financial disadvantage of not applying the exemption is minor due to the VAT Compensation Fund (BCF), but this is contested because every euro claimed from the BCF ultimately impacts the Municipal Fund.

- The article questions whether the disadvantage of not applying the exemption is truly as small as the Ministry claims, especially given the financial structure and limitations of the BCF.

Source: efkbelastingadviseurs.nl

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

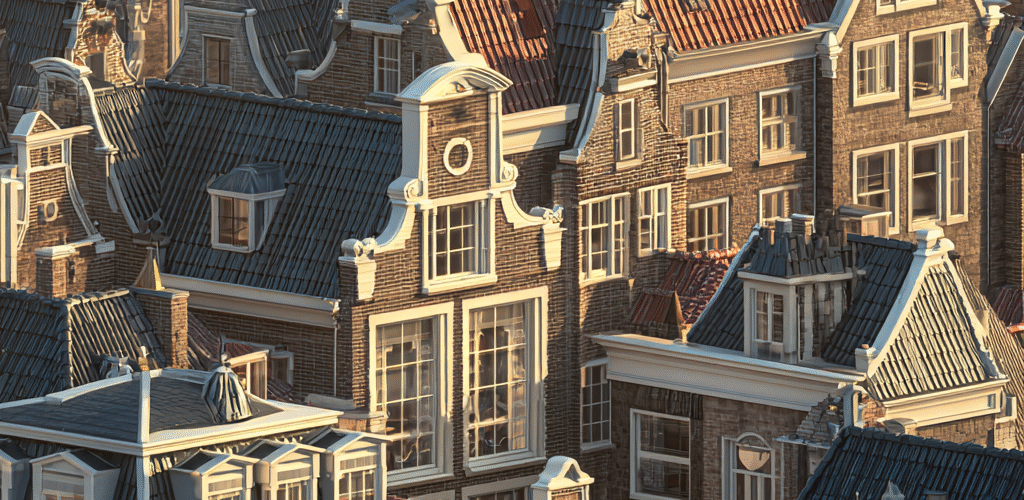

Latest Posts in "Netherlands"

- Supreme Court Ruling: Customs Duties and VAT on Flea Treatment Products for Cats and Dogs

- Artistic Murals Do Not Qualify as House Painting for Reduced VAT Rate Under Dutch Law

- Key Changes to Zero VAT Rate Decree Table II Effective February 28, 2026

- Reduced VAT Rate Not Applicable to Artistic Murals, Only to Residential Painting and Plastering

- VAT Exemption Not Applicable to Credit Management After Sale of Credits, Says Advocate General