- The CJEU ruled that tax courts can independently assess the right to deduct VAT, using evidence from dismissed criminal cases against third parties, as long as the rights of the defense are maintained.

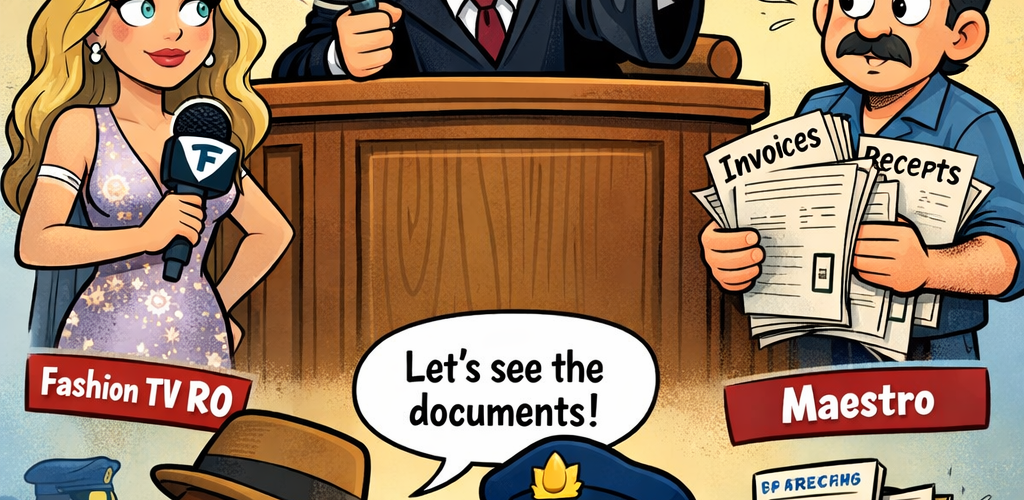

- In the case of Fashion TV RO SRL, the Romanian tax authorities denied VAT deduction based on claims of fictitious transactions linked to inactive suppliers, despite the dismissal of criminal charges against the company’s director and accountant due to insufficient evidence.

- The court clarified that the ne bis in idem principle does not apply here, as it involves different legal entities, and reaffirmed that national courts must verify VAT deduction criteria, allowing for the consideration of evidence from criminal proceedings to establish potential fraud or misuse.

Source BTW Jurisprudentie

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- GCEU Rules on VAT Liability for Intra-EU Trade and Incorrectly Charged VAT in Member States

- VAT Exemption Likely Denied for Securitised Loan Management, Says EU Advocate General

- VAT Exemption for Credit Management After Sale: Finnish Case on Housing Loans and EU Directive

- Intrastat Thresholds and Deadlines: Key Changes for 2026 Across EU Member States

- CBAM in Europe: One Regulation, Many National Gateways and Varied Implementation Approaches