Belgium Becomes the First Country to Reach One Million Registered Peppol e‑Invoice Recipients — A Triumph of Standardization Over Innovation

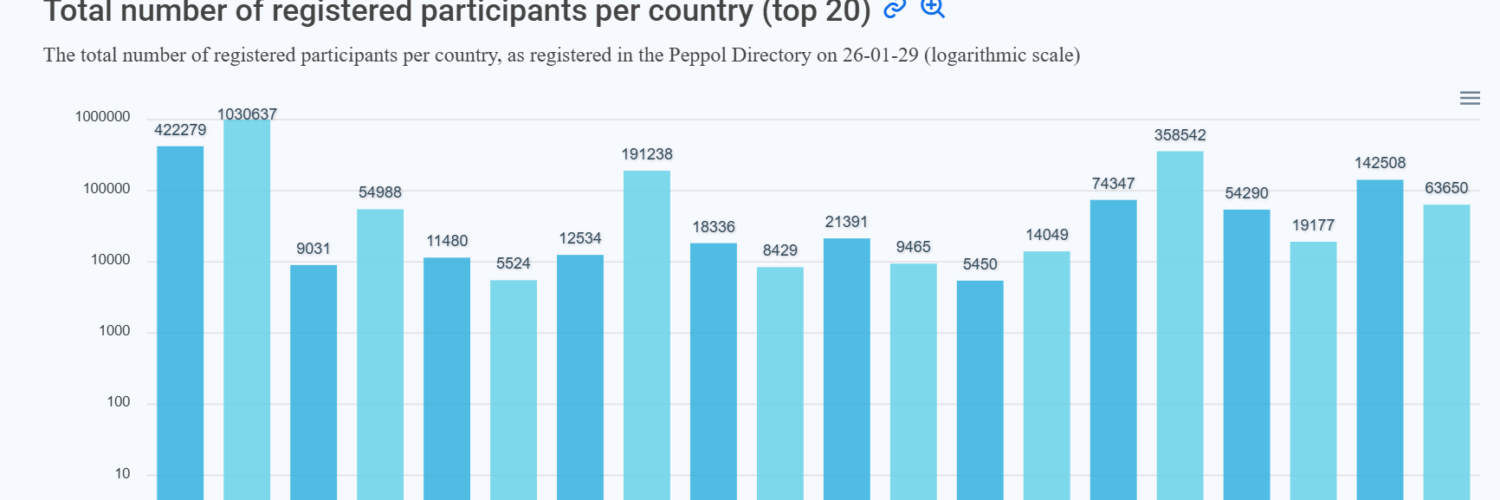

A major milestone in Europe’s digital transformation journey! Belgium has officially become the first European country to exceed one million Peppol‑registered e‑invoice recipients, reinforcing its position as a frontrunner in e‑invoicing adoption and digital tax compliance.

This achievement is more than a number—it’s a strong signal of Belgium’s commitment to:

🔹 Streamlined, automated financial processes

🔹 Greater transparency and reduced VAT fraud

🔹 Faster, more secure invoice exchange

🔹 Full readiness for the upcoming 2026 B2B e‑invoicing mandate

With the country’s mandatory structured e‑invoicing rules starting 1 January 2026, this rapid adoption shows how effectively Belgian businesses—small and large—are embracing the future of compliant, efficient digital operations.

As someone deeply involved in tax and digital reporting transformation, it’s inspiring to see such decisive progress. This is the kind of momentum Europe needs as we move toward ViDA and a fully interoperable e‑invoicing landscape.

Congratulations to all stakeholders driving this change—public authorities, software providers, and businesses upgrading their systems to be ready for the next era of digital compliance.

🔗 The future of invoicing is connected. And Belgium is leading the way.

Source ionite.net

Latest Posts in "Belgium"

- EGC T-575/24 (Digipolis) – Judgment – Public Law body Held Liable for VAT on Telecommunication Services Provided

- Belgium Updates VAT Rates for Pesticides and Furnished Accommodations Effective March 1, 2026

- Belgium Raises VAT on Pesticides to 21% and Accommodation to 12% from March 2026

- Belgium Confirms March 2026 VAT Hikes on Hotels, Campsites, and Pesticides; Delays Others

- Construction Sector Urges Lower VAT on New Builds to Tackle Belgium’s Housing Crisis