- If you install solar panels on roofs, remain the owner, and then rent them out, specific VAT rules apply.

- The Dutch Tax Authority recently provided clarification on how to handle VAT in this situation.

- The main issue concerns VAT treatment for non-integrated solar panels that are installed and subsequently rented out.

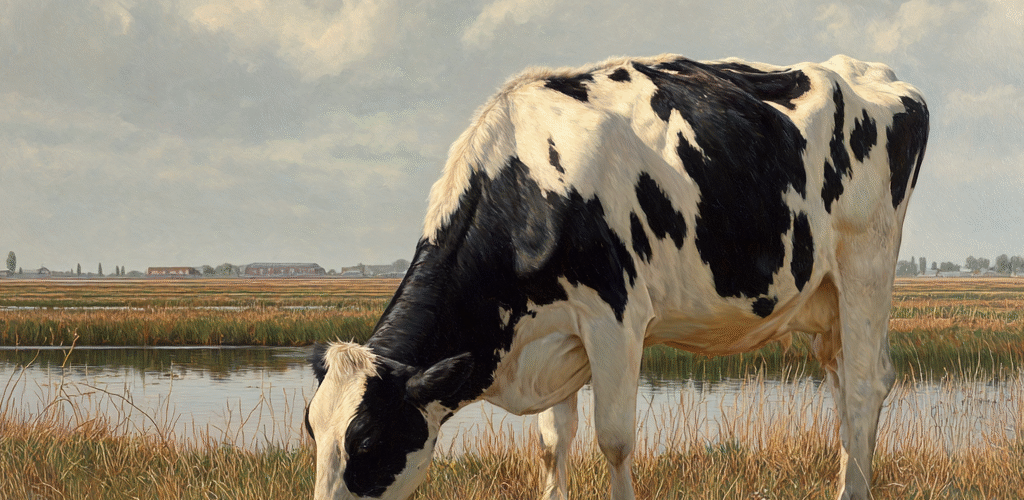

Source: londenholland.nl

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Netherlands"

- Holding and Subsidiary Form VAT Fiscal Unity Due to Financial and Organizational Interdependence

- BVs managed by one person with non-negligible economic ties, therefore Fixed Establishment for VAT purposes

- Abuse of litigation through the use of AI: reimbursement of full legal costs

- The use of practice assistants at general practitioners’ practices qualifies as VAT-exempt care

- No VAT exemption for smoking cessation coaches