- The IVA Conference marked 70 years of VAT and focused on its evolution and future in a changing global economy.

- Key discussions included strengthening VAT/GST systems in developing countries, especially for small enterprises, refund mechanisms, and leveraging new technologies.

- The Indirect Taxation Subcommittee addressed balancing efficient VAT refunds (especially for exports and capital expenditures) with fraud prevention.

- Technological innovation, including AI and blockchain, is transforming VAT compliance and enforcement, as shared by Brazil, France, and Chile.

- The European Commission’s ViDA initiative aims to modernize and simplify VAT across the EU, adapting it to the digital economy.

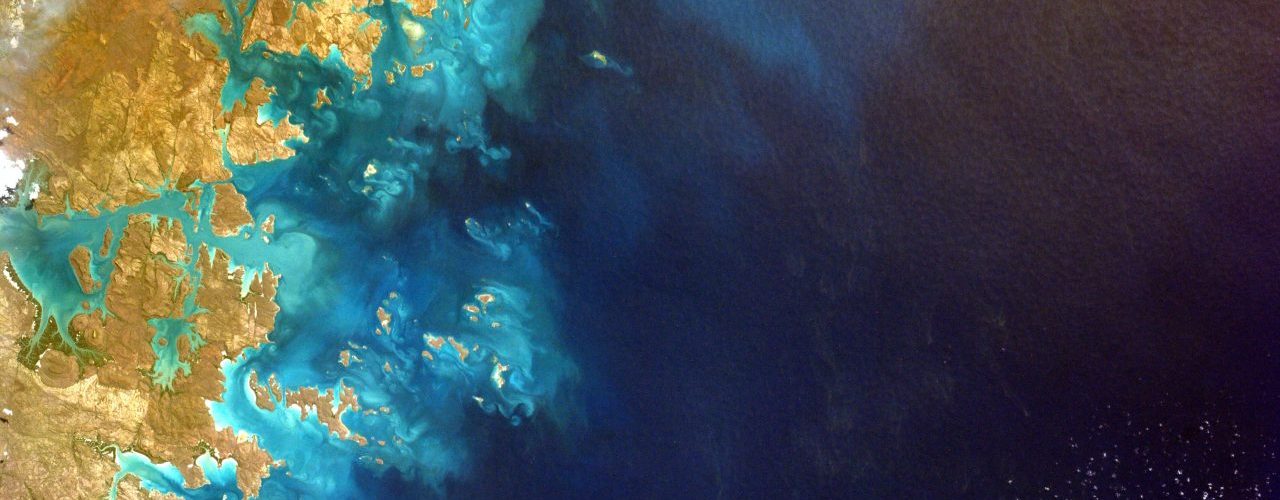

Source: tax.athene.no

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "World"

- Withholding VAT on Non-Resident Digital Services: Mechanisms, Compliance, and Global Approaches

- OECD Issues Guidance on Digital Continuous Transaction Reporting for VAT Compliance and Implementation

- Why E-invoices Get Rejected After Validation: 9 Essential Data Enrichments for Compliance

- Global VAT and Indirect Tax Rate Changes Effective in 2026: Key Updates by Jurisdiction

- E–invoicing Developments Tracker