⚖️ Background

Parties

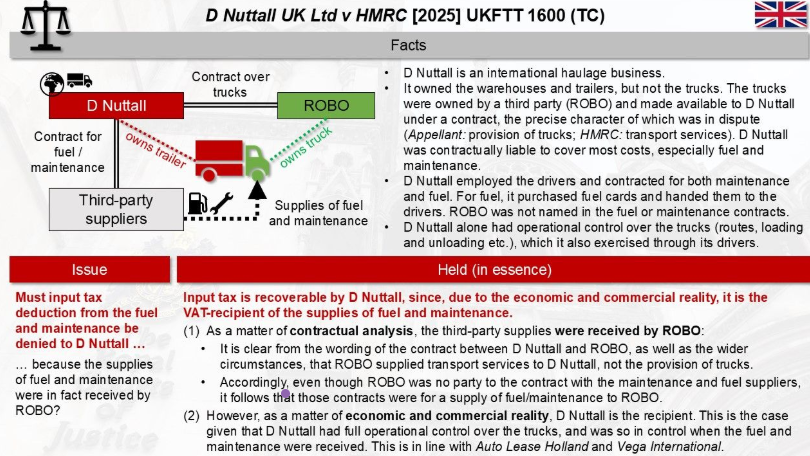

- D Nuttall UK Ltd (DNUK): a UK-based haulage company operating its own trailers and coordinating transport services.

- ROBO International S.R.L (“ROBO”): a Romanian company, wholly separate from DNUK during the relevant period (later acquired by DNUK), supplying traction services via trucks.

- HMRC: challenged DNUK’s VAT deductions related to fuel and truck repair services.

Supply Arrangements

- DNUK needed trucks to haul goods but chose not to hold a goods vehicle operator’s licence.

- Instead, it entered into a written contract with ROBO (January 2020), under which:

- ROBO provided trucks and drivers;

- DNUK paid a fixed per-kilometre charge, covering costs like fuel, repairs, tolls, and maintenance. [pumptax.com]

- DNUK separately contracted with suppliers (fuel providers, mechanics) and paid them directly—ROBO was not party to these contracts. [pumptax.com], [pumptax.com]

The Dispute

HMRC issued VAT assessments for the period September 2019 to March 2023, excluding September 2022, denying DNUK’s right to input tax relief on fuel and repair costs. HMRC argued that these supplies were made to ROBO—not to DNUK—and thus DNUK was not entitled to claim input VAT. [pumptax.com]

DNUK appealed, contending that despite contractual wording, the “economic and commercial reality” showed that it was the true recipient of the supplies—and therefore eligible for input tax recovery under VAT legislation. [pumptax.com], [pumptax.com]

Legal Framework

Under the VAT Act 1994:

- A taxable person may recover input VAT on supplies “made to him” in the course of his business (Sections 24–26 VATA). [pumptax.com]

- To determine whether DNUK was the recipient, the tribunal applied the two-stage test from AirTours v HMRC (2016) and further cases:

- Contractual analysis: Assess what the contract stipulates regarding recipient rights/obligations.

- Economic and commercial reality: Look beyond the contract to see how the arrangement functioned in practice. [pumptax.com]

Tribunal Findings

Contractual Viewpoint

- Fuel and repair contracts were bilateral agreements between DNUK and the suppliers.

- However, terms referenced ROBO as the ultimate user, aligning with HMRC’s argument. [claritaxnews.com], [pumptax.com]

Economic Reality

Despite formal contract language, the Tribunal found that:

- ROBO’s role was passive—providing trucks and drivers, while DNUK controlled usage, bore all operational costs (fuel, maintenance), and decided logistics. [pumptax.com], [pumptax.com]

- Financially, ROBO merely charged a fixed fee, resembling a leasing arrangement rather than a supply recipient–provider relationship. [pumptax.com], [claritaxnews.com]

- Comparing AirTours, Airtours, Newey, and U-Drive, the Tribunal determined that the contract’s description was “purely artificial” and did not reflect the real nature of events. [pumptax.com]

Therefore, the Tribunal concluded that the fuel and repair services were indeed supplied to DNUK, entitling it to recover the input VAT. The appeal was allowed—DNUK was owed relief on all designated VAT periods. [pumptax.com], [pumptax.com]

Implications for Tax & Transport

- Contract vs. Substance: This case reinforces that HMRC and tribunals will look beyond contracts to the actual use and payment structure. Artificial arrangements may be disregarded in favor of economic reality.

- Input VAT Recovery: Businesses hiring vehicles via third parties must scrutinize whether these costs are directly incurred in the course of their trade—if so, VAT relief may be available.

- Operational Autonomy: Actual control and payment for costs (fuel, maintenance) signal that the hirer—not the vehicle provider—is the rightful recipient of services for VAT purposes.

Key Takeaways

- A rigid contractual structure cannot override the undeniable practical reality of who benefits and bears costs.

- DNUK prevailed without vehicle ownership—by demonstrating full control and financial responsibility.

- VAT professionals and transport/logistics firms should evaluate whether their operational model signals economic substance over contract labels.

By challenging HMRC on both formal contractual terms and actual business practices, D Nuttall UK Ltd successfully made the case that it, not ROBO, deserved the input VAT credit—marking a strong precedent in VAT jurisprudence.

See also

- Background and Dispute: D Nuttall UK Ltd, an international haulage business, faced a challenge from HMRC regarding its input tax claims on fuel and maintenance costs for trucks provided by a Romanian company, ROBO, which was later acquired by the taxpayer. HMRC contended that the services were supplied to ROBO, not the taxpayer, and thus input tax claims were invalid.

- FTT’s Two-Stage Analysis: The First-tier Tribunal (FTT) applied a two-stage test to assess the contractual position and economic reality of the arrangement. It found that while the contractual agreement reflected HMRC’s view, the economic and commercial reality demonstrated that the taxpayer had control over the trucks and was responsible for all associated costs, thereby justifying the input tax claims.

- Outcome of the Appeal: The FTT concluded that ROBO’s role was merely to make the trucks available to the taxpayer, who effectively managed the transport operations. As a result, the taxpayer’s appeal was allowed, affirming its entitlement to reclaim the VAT on the disputed costs.

Source KPMG

Related ECJ cases

Briefing document & Podcast: C-185/01 (Auto Lease Holland BV): VAT Refund on Fuel Supply – VATupdate

Latest Posts in "United Kingdom"

- VAT: Cattle Bed and Breakfast Service Is Single Standard-Rated Supply, Appeal Dismissed

- HMRC Requires Online Registration for Tax Advisers’ Agent Services Account Starting May 2026

- FTT Upholds HMRC Refusal of Input VAT Recovery Without Invoices in Mochars Ltd Case

- Tribunal Rules EV Charging Points Qualify for Reduced 5% VAT Rate Under Domestic Use Provision

- Who Can Reclaim Import VAT in the UK? HMRC Rules on Ownership and Importer of Record