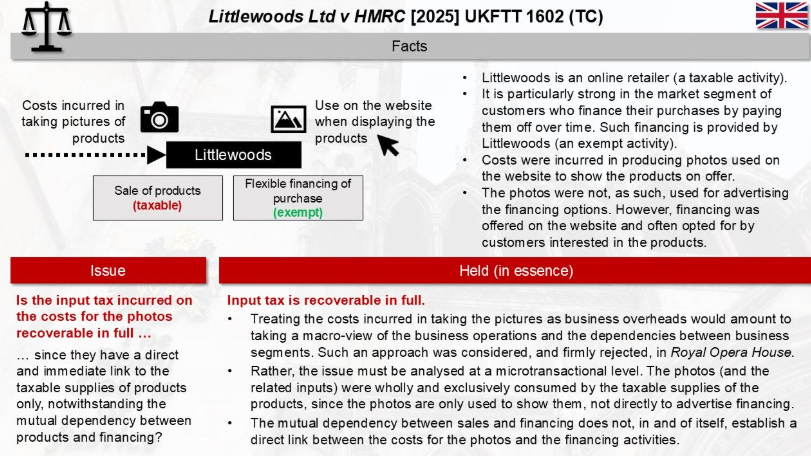

️ Case Overview

- Parties: Littlewoods Ltd (a retailer offering finance and insurance options) vs HMRC

- Decision Date: 2025

- Tribunal: First-tier Tribunal (Tax Chamber) – cited as UKFTT 1602 (TC) [claritaxnews.com], [gov.uk]

Key Issue

Does input VAT on product-specific photography (used in online catalogues) qualify for full recovery when the vendor offers both taxable (retail goods) and exempt (credit and insurance) services?

- HMRC argued that the photography costs were “residual”—so they should be recovered only proportionately—and possibly linked to exempt finance services.

- Littlewoods contended the photos were exclusively used to drive retail sales (taxable), entitling them to full VAT recovery.

⚖️ Tribunal’s Legal Analysis

The FTT applied established VAT law and key precedents, emphasising:

- Direct & Immediate Link Requirement

- Costs are recoverable only if directly and immediately connected to taxable transactions. [claritaxnews.com]

- Integrated Business Test

- HMRC argued Littlewoods ran a symbiotic business—retail, finance, and insurance being inseparable.

- FTT disagreed, ruling that while the services facilitated each other, this didn’t establish a direct link between the photography and the exempt activities. [claritaxnews.com]

- Mixed‑Use Argument

- Even if photos were used alongside credit options, they functioned solely to display products.

- Any connection to credit was indirect—photos informed customers about products, not about how to finance them. [claritaxnews.com]

Decision

The Tribunal allowed Littlewoods’ appeal:

- The input VAT on product photography is fully recoverable, since it is a direct cost necessary for taxable retail sales.

- The Tribunal rejected HMRC’s integrated-business and mixed‑use arguments. [claritaxnews.com]

A full version of the Tribunal’s judgment is available on the National Archives website. [claritaxnews.com], [gov.uk]

Implications for Businesses

- Partial Exemption Clarity: Businesses offering both taxable and exempt services can recover VAT on certain inputs, even if the business model integrates multiple supply types—provided a direct and immediate link to taxable sales can be shown.

- Documentation & Analysis: It’s critical to analyze each input cost’s commercial use and maintain evidence proving its direct connection to taxable activities.

Final Takeaway

UKFTT 1602 reaffirms that an integrated business structure doesn’t automatically invalidate full VAT recovery. What matters is the actual, objective link between cost and taxable output. For businesses with mixed supplies, this decision underscores the importance of dissecting individual costs and linking them properly to taxable revenues.

See also

Other newsletters

- Taxpayer’s Position: Littlewoods Ltd argued that the costs incurred for photography and modeling, related to product-specific photographs, were solely for making taxable supplies (goods) and thus the VAT on these costs should be fully recoverable.

- HMRC’s Argument: HMRC contended that Littlewoods operated an integrated business model that combined taxable goods and exempt financial services, asserting that the photographs served mixed purposes and should thus be treated as mixed-use costs, limiting VAT recovery.

- FTT Ruling: The First-tier Tribunal ruled in favor of Littlewoods, concluding that the photographs primarily served to inform and display products, without establishing a direct link to exempt financial services. The court emphasized that the use of photographs did not automatically imply a connection to credit services, allowing for full VAT recovery on the related costs.

Source KPMG

Latest Posts in "United Kingdom"

- UK VAT Rules on Online Prize Draws Face Scrutiny Amid New Voluntary Code and Industry Growth

- How UK Businesses Accidentally Trigger US State Sales Tax Through Ecommerce and Economic Nexus

- Director Liable for VAT Fraud and PAYE/NIC on Withdrawals: Ellis & Anor v HMRC (2026)

- UK VAT Gap Rises to £11.9bn in 2024–25, HMRC Reports 6.5% Shortfall

- Luzha v HMRC: VAT Late Submission Penalties Upheld, No Reasonable Excuse Found, Appeal Dismissed