- Full VAT Deduction Allowed: The Supreme Administrative Court ruled on January 8, 2025, that cultural institutions, such as museums, can deduct 100% of VAT on investments related to modernization and renovation projects, without applying a pre-factor that limits VAT deductions.

- Significance of the Ruling: This decision marks a significant departure from previous rulings that often denied full VAT deductions to cultural institutions. The Court emphasized that each case should be individually assessed, rather than adhering to a blanket assumption that cultural institutions cannot fully deduct VAT.

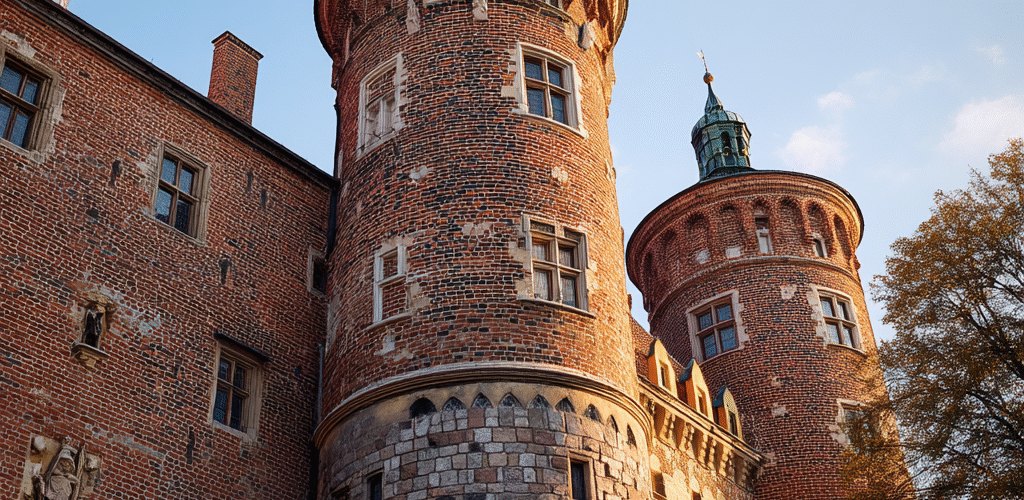

- Impact on Cultural Institutions: The judgment is particularly important for museums, theatres, galleries, and similar entities, allowing them to claim full VAT deductions on expenses related to essential investments, thereby providing financial relief and encouraging further development in the cultural sector.

Source Prawo

Latest Posts in "Poland"

- Entrepreneurs will be punished for not joining the KSeF in 2026

- ePUAP, e-Delivery and the transitional period: how to effectively correspond with courts and the tax authorities in 2026

- Corrections in KSeF: Farewell to the “yellow folder” and welcome to the era of ID

- PDF Invoices Cannot Be Corrected Instead of KSeF, Says Finance Ministry; Sanctions from 2027

- Date in Field P_1 Is Invoice Issue Date for VAT Purposes, Not KSeF Creation Date