SUMMARY

This document provides a summary of key themes and information from the provided excerpts on VAT Rate Application and Structure (Title VIII). It focuses on the application of different VAT rates, standard rates, reduced rates, and exceptional situations.

I. Key Themes:

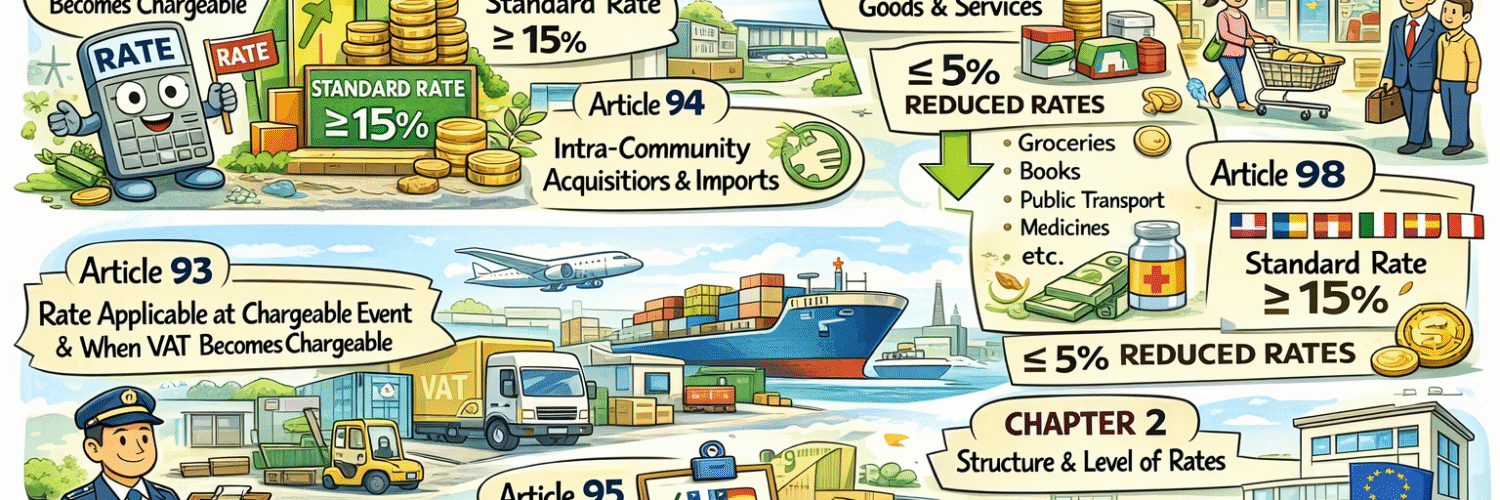

- Taxable Event vs. Chargeable Event: The general rule is that the VAT rate in force at the time of the chargeable event applies. However, exceptions exist where the rate in force when VAT becomes chargeable applies (Articles 65, 66, intra-Community acquisitions, and specific importation cases).

- Standard Rate Application: Each Member State must have a standard VAT rate applicable to both goods and services, fixed as a percentage of the taxable amount. A minimum standard rate of 15% is mandated (Article 97).

- Reduced Rate Application: Member States can apply a maximum of two reduced rates (minimum 5%) to specific goods and services listed in Annex III. Further reductions below 5%, and exemptions with deductibility are possible, but limited to a maximum of seven points in Annex III. These reduced rates cannot apply to electronically supplied services (with limited exceptions).

- Adjustments for Rate Changes: Member States can make adjustments and adopt transitional measures when VAT rates are changed, particularly in cases referred to in Articles 65 and 66.

- Specific Goods: The treatment of works of art, collectors’ items, and antiques has specific rules, particularly regarding the application of standard or reduced rates during importation, and their interaction with special arrangements in Title XII, Chapter 4.

- Exceptional Circumstances (Disaster Relief): Provisions exist for Member States to grant exemptions with deductibility of VAT for goods imported or acquired for disaster relief, mirroring authorizations under Council Directive 2009/132/EC.

- Reporting and Review: The Commission is obligated to submit reports on the scope of Annex III every five years, beginning on December 31, 2028.

II. Important Ideas and Facts:

- Article 93: “The rate applicable to taxable transactions shall be that in force at the time of the chargeable event. However, in the following situations, the rate applicable shall be that in force when VAT becomes chargeable: (a) in the cases referred to in Articles 65 and 66; (b) in the case of an intra-Community acquisition of goods; (c) in the cases concerning the importation of goods referred to in the second subparagraph of Article 71(1) and in Article 71(2).” This highlights the general rule and the key exceptions relating to the time at which the VAT rate is determined.

- Article 97: “The standard rate shall not be lower than 15%.” Establishes a firm minimum for the standard VAT rate across Member States.

- Article 98: “Member States may apply a maximum of two reduced rates. The reduced rates shall be fixed as a percentage of the taxable amount, which shall not be less than 5% and shall apply only to the supplies of goods and services listed in Annex III.” Defines the permissible use of reduced rates, the minimum level, and the linkage to Annex III.

- Article 98(2): Addresses the limitations and sunset clauses for applying reduced rates lower than 5% or granting exemptions. “Member States applying, on 1 January 2021, reduced rates lower than the minimum of 5% or granting exemptions with deductibility of the VAT paid at the preceding stage to supplies of goods or services covered in more than seven points in Annex III, shall limit the application of those reduced rates or the granting of those exemptions to comply with the first subparagraph of this paragraph by 1 January 2032 or by the adoption of the definitive arrangements referred to in Article 402, whichever is earlier.” This is an important transitional provision.

- Article 101a: Details the conditions under which a Member State can grant VAT exemptions with deductibility for goods and services related to disaster relief, under certain conditions linked to Council Directive 2009/132/EC.

- Article 100: “By 31 December 2028 and every five years thereafter, the Commission shall submit to the Council a report on the scope of Annex III, accompanied by any appropriate proposals, where necessary.” This ensures periodic review and potential updates to the list of goods and services eligible for reduced rates.

III. Implications:

- Compliance: Businesses need to understand the specific VAT rates applicable in each Member State and the rules for determining when the rate applies, particularly regarding cross-border transactions.

- Strategic Planning: Member States have flexibility within defined parameters to set their VAT rates, which can influence consumer behavior and business decisions. The limitations on reduced rates and exemptions, and the sunset clause for certain existing practices, necessitate planning for compliance by the relevant deadlines.

- Potential for Change: The Commission’s periodic review of Annex III may lead to changes in the goods and services eligible for reduced rates, impacting businesses and consumers.

- Disaster Relief: The provisions for VAT exemptions in disaster situations provide a framework for rapid and effective aid delivery.

Other articles on ”Unwrapping the EU VAT Directive 2006/112/EC):

- Title I: Subject Matter & Scope (Art. 1-4)

- Title II: Territorial Scope (Art. 5-8)

- Tille III: Taxable Person (Art. 9-13)

- Title IV: Taxable Transactions (Art. 14-30)

- Title V: Place of supply (Art.31 – 61)

- Title VI: Chargeable Event & Chargeability of VAT (Art. 62-71)

- Title VII: Taxable Amount (Art. 72-92)

- Title VIII: Rates (Art. 93-129a)

- Title IX: Exemptions (Art. 131-166)

- Title X: Deductions (Art. 167-192)

- Title XI: Obligations of taxable persons and certain non-taxable persons (Art. 192a-280)

- Title XII: Special Schemes (Art. 280a-369cz)

- Title XIII: Derogations (Art. 370-396)

- Title XIV: Miscellaneous (Art. 397-401)

- Title XV: Final provisions (Art. 402-414)

Articles in the EU VAT Directive

TITLE VIII

RATES

CHAPTER 1

Application of Rates

Article 93

The rate applicable to taxable transactions shall be that in force at the time of the chargeable event. However, in the following situations, the rate applicable shall be that in force when VAT becomes chargeable:

(a) in the cases referred to in Articles 65 and 66;

(b) in the case of an intra-Community acquisition of goods;

(c) in the cases concerning the importation of goods referred to in the second subparagraph of Article 71(1) and in Article 71(2).

Article 94

- The rate applicable to the intra-Community acquisition of goods shall be that applied to the supply of like goods within the territory of the Member State.

- The rate applicable to the importation of goods shall be that applied to the supply of like goods within the territory of the Member State.

- By way of derogation from paragraph 2 of this Article, Member States applying a standard rate to the supply of works of art, collectors’ items, and antiques listed in Annex IX, Parts A, B, and C, may apply a reduced rate as provided for in Article 98(1), first subparagraph, to the importation of those goods within the territory of the Member State.

Article 95

Where rates are changed, Member States may, in the cases referred to in Articles 65 and 66, effect adjustments in order to take account of the rate applying at the time when the goods or services were supplied. Member States may also adopt all appropriate transitional measures.

CHAPTER 2

Structure and Level of Rates

Section 1

Standard Rate

Article 96

Member States shall apply a standard rate of VAT, which shall be fixed by each Member State as a percentage of the taxable amount and which shall be the same for the supply of goods and for the supply of services.

Article 97

The standard rate shall not be lower than 15%.

Section 2

Reduced Rates

Article 98

- Member States may apply a maximum of two reduced rates. The reduced rates shall be fixed as a percentage of the taxable amount, which shall not be less than 5% and shall apply only to the supplies of goods and services listed in Annex III. Member States may apply the reduced rates to supplies of goods or services covered in a maximum of 24 points in Annex III.

- Member States may, in addition to the two reduced rates referred to in paragraph 1 of this Article, apply a reduced rate lower than the minimum of 5% and an exemption with deductibility of the VAT paid at the preceding stage to supplies of goods or services covered in a maximum of seven points in Annex III. The reduced rate lower than the minimum of 5% and the exemption with deductibility of the VAT paid at the preceding stage may only be applied to supplies of goods or services covered in the following points of Annex III:

(a) points (1) to (6) and (10c);

(b) any other point of Annex III falling under the options provided for in Article 105a(1).

For the purposes of point (b) of the second subparagraph of this paragraph, the transactions regarding housing referred to in Article 105a(1), second subparagraph, shall be regarded as falling under Annex III, point (10).

Member States applying, on 1 January 2021, reduced rates lower than the minimum of 5% or granting exemptions with deductibility of the VAT paid at the preceding stage to supplies of goods or services covered in more than seven points in Annex III, shall limit the application of those reduced rates or the granting of those exemptions to comply with the first subparagraph of this paragraph by 1 January 2032 or by the adoption of the definitive arrangements referred to in Article 402, whichever is earlier. Member States shall be free to determine to which supplies of goods or services they will continue to apply those reduced rates or grant those exemptions. - The reduced rates and the exemptions referred to in paragraphs 1 and 2 of this Article shall not apply to electronically supplied services, except to those listed in Annex III, points (6), (7), (8), and (13).

- When applying the reduced rates and exemptions provided for in this Directive, Member States may use the Combined Nomenclature or the statistical classification of products by activity, or both, to establish the precise coverage of the category concerned.

Article 98a

The reduced rates and the exemptions referred to in Article 98(1) and (2) shall not apply to supplies of works of art, collectors’ items, and antiques to which the special arrangements of Title XII, Chapter 4, are being applied.

Article 100

By 31 December 2028 and every five years thereafter, the Commission shall submit to the Council a report on the scope of Annex III, accompanied by any appropriate proposals, where necessary.

Section 2a

Exceptional Situations

Article 101a

- Where an authorization has been granted to a Member State by the Commission in accordance with Article 53, first paragraph, of Council Directive 2009/132/EC to apply an exemption on goods imported for the benefit of disaster victims, that Member State may grant an exemption with deductibility of the VAT paid at the preceding stage under the same conditions, in respect of the intra-Community acquisitions and the supply of those goods and services related to such goods, including rental services.

- A Member State wishing to apply the measure referred to in paragraph 1 shall inform the VAT Committee.

- When goods or services acquired by the organizations benefiting from the exemption laid down in paragraph 1 of this Article are used for purposes other than those provided for in Title VIII, Chapter 4, of Directive 2009/132/EC, the use of such goods or services shall be subject to VAT under the conditions applicable at the time when the conditions for the exemption cease to be fulfilled.

Section 3

Particular Provisions

Article 104

- Austria may, in the communes of Jungholz and Mittelberg (Kleines Walsertal), apply a second standard rate that is lower than the corresponding rate applied in the rest of Austria but not less than 15%.

- Greece may apply rates up to 30% lower than the corresponding rates applied in mainland Greece in the departments of Lesbos, Chios, Samos, the Dodecanese, and the Cyclades, and on the islands of Thassos, the Northern Sporades, Samothrace, and Skiros.

- Portugal may, in the case of transactions carried out in the autonomous regions of the Azores and Madeira and of direct importation into those regions, apply rates lower than those applicable on the mainland.

- Portugal may apply one of the two reduced rates provided for in Article 98(1) to the tolls on bridges in the Lisbon area.

Article 105a

- Member States which, in accordance with Union law, on 1 January 2021, were applying reduced rates lower than the minimum laid down in Article 98(1) or were granting exemptions with deductibility of the VAT paid at the preceding stage, to the supply of goods or services listed in points other than Annex III, points (1) to (6) and (10c), may, in accordance with Article 98(2), continue to apply those reduced rates or grant those exemptions, without prejudice to paragraph 4 of this Article.

Member States which, in accordance with Union law, on 1 January 2021, were applying reduced rates lower than the minimum laid down in Article 98(1) to transactions regarding housing not being part of a social policy, may, in accordance with Article 98(2), continue to apply those reduced rates.

Member States shall communicate to the VAT Committee the text of the main provisions of national law and the conditions for the application of the reduced rates and exemptions relating to Article 98(2), second subparagraph, no later than 7 July 2022.

Without prejudice to paragraph 4 of this Article, reduced rates lower than the minimum laid down in Article 98(1), or exemptions with deductibility of the VAT paid at the preceding stage may be applied by other Member States, in accordance with Article 98(2), first subparagraph, to the same supplies of goods or services as those referred to in the first and second subparagraphs of this paragraph and under the same conditions as those applicable on 1 January 2021 in the Member States referred to in the first and second subparagraphs of this paragraph. - Member States which, in accordance with Union law, on 1 January 2021, were applying reduced rates lower than 12%, including reduced rates lower than the minimum laid down in Article 98(1), or were granting exemptions with deductibility of the VAT paid at the preceding stage, to the supply of goods or services other than those listed in Annex III, may, in accordance with Article 98(1) and (2), continue to apply those reduced rates or grant those exemptions until 1 January 2032 or until the adoption of the definitive arrangements referred to in Article 402, whichever is earlier, without prejudice to paragraph 4 of this Article.

- Member States which, in accordance with Union law, on 1 January 2021, were applying reduced rates not lower than 12% to the supply of goods or services other than those listed in Annex III, may, in accordance with Article 98(1), first subparagraph, continue to apply those reduced rates, without prejudice to paragraph 4 of this Article.

Member States shall communicate to the VAT Committee the text of the main provisions of national law and conditions for the application of the reduced rates referred to in the first subparagraph of this paragraph no later than 7 July 2022.

Without prejudice to paragraph 4 of this Article, reduced rates not lower than 12% may be applied by other Member States, in accordance with Article 98(1), first subparagraph, to the same supplies of goods or services as those referred to in the first subparagraph of this paragraph and under the same conditions as those applicable on 1 January 2021 in the Member States referred to in the first subparagraph of this paragraph. - By way of derogation from paragraphs 1, 2, and 3, the reduced rates or exemptions with deductibility of the VAT paid at the preceding stage on fossil fuels, other goods with a similar impact on greenhouse gas emissions, such as peat, and wood used as firewood shall cease to apply by 1 January 2030. The reduced rates or exemptions with deductibility of the VAT paid at the preceding stage on chemical pesticides and chemical fertilizers shall cease to apply by 1 January 2032.

- Member States which, in accordance with the fourth subparagraph of paragraph 1 of this Article, the third subparagraph of paragraph 3 of this Article, and Article 105b, wish to apply the reduced rates not lower than 12%, the reduced rates lower than the minimum laid down in Article 98(1), or the exemptions with deductibility of the VAT paid at the preceding stage, shall, by 7 October 2023, adopt the detailed rules governing the exercise of those options. They shall communicate to the VAT Committee the text of the main provisions of national law they have adopted.

- By 1 July 2025, based on the information provided by Member States, the Commission shall present to the Council a report with a comprehensive list indicating the goods and services referred to in paragraphs 1 and 3 of this Article and in Article 105b to which the reduced rates, including the reduced rates lower than the minimum laid down in Article 98(1), or the exemptions with deductibility of the VAT paid at the preceding stage are applied in Member States.

Article 105b

Member States which, in accordance with Union law, on 1 January 2021, were applying reduced rates not lower than the minimum of 5% to transactions regarding housing not being part of a social policy, may, in accordance with Article 98(1), first subparagraph, continue to apply those reduced rates. In such a case, the reduced rates to be applied to such transactions shall, as of 1 January 2042, not be lower than 12%.

Member States shall communicate to the VAT Committee the text of the main provisions of national law and conditions for the application of the reduced rates referred to in the first paragraph no later than 7 July 2022.

A reduced rate not lower than 12% may be applied by other Member States, in accordance with Article 98(1), first subparagraph, to the transactions referred to in the first paragraph of this Article under the same conditions as those applicable on 1 January 2021 in the Member States referred to in the first paragraph of this Article.

For the purposes of Article 98(1), third subparagraph, the transactions referred to in this Article shall be regarded as falling under Annex III, point (10).

CHAPTER 5

Temporary Provisions

Article 129a

- Member States may take one of the following measures:

(a) apply a reduced rate to the supply of COVID-19 in vitro diagnostic medical devices and services closely linked to those devices;

(b) grant an exemption with deductibility of VAT paid at the preceding stage in respect of the supply of COVID-19 in vitro diagnostic medical devices and services closely linked to those devices.

Only COVID-19 in vitro diagnostic medical devices that are in conformity with the applicable requirements set out in Directive 98/79/EC of the European Parliament and of the Council or Regulation (EU) 2017/746 of the European Parliament and of the Council and other applicable Union legislation shall be eligible for the measures provided for in the first subparagraph. - Member States may grant an exemption with deductibility of VAT paid at the preceding stage in respect of the supply of COVID-19 vaccines and services closely linked to those vaccines. Only COVID-19 vaccines authorized by the Commission or by Member States shall be eligible for the exemption provided for in the first subparagraph.

- This Article shall apply until 31 December 2022.

Latest Posts in "European Union"

- EU Updates E-Invoicing Standard and Proposes Major Financial Sector Tax Reforms

- EU Approves EN 16931 E-Invoicing Updates, Proposes Financial Sector Tax Harmonization Reforms

- AG: Director Must Be Able to Appeal VAT Assessments Imposed on Company Under EU Law

- Andrés Ritter Appointed as New European Chief Prosecutor, Succeeding Kövesi in November 2026

- Reduced Hotel VAT Rate May Exclude Extras Like Breakfast, Parking, Wellness, Fitness, and WiFi