- Concentrated Problem: Over half of the total EU VAT gap in 2023 originated from just three countries (Italy, France, Germany), indicating that progress in a few large economies significantly impacts the overall EU average.

- Beyond Enforcement: Improvements in the VAT gap, such as Italy’s halving between 2018 and 2022, can be driven by policy tools outside tax enforcement (e.g., subsidies like “Superbonus 110”) that change behavior and formalize transactions.

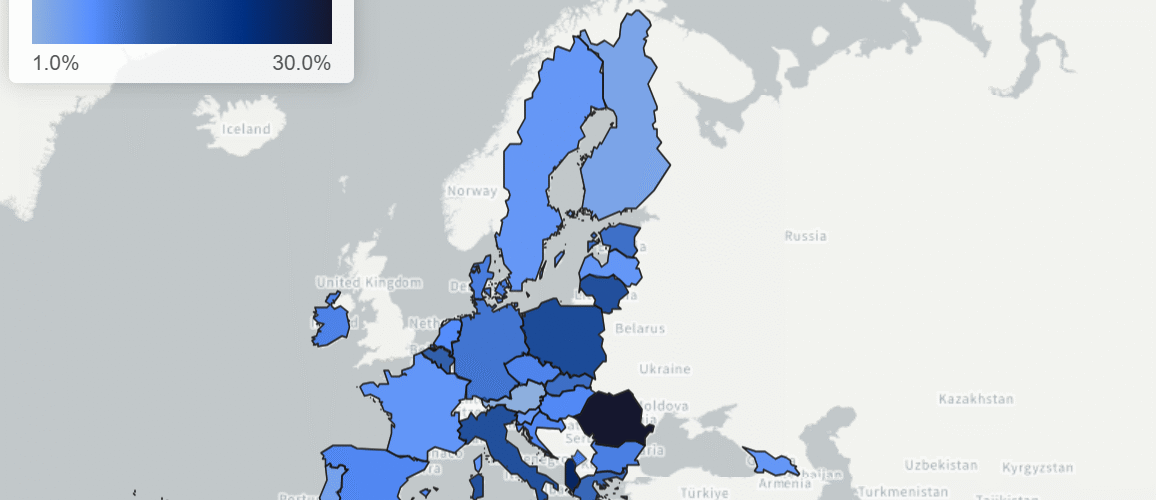

- Fragile Gains & Policy Impact: Post-COVID VAT gap gains are reversing, with the average EU VAT gap increasing to 9.5% in 2023, suggesting compliance gains are not permanent. Furthermore, the “policy gap” (revenue foregone due to legal choices like reduced rates) is often larger than the compliance gap in many countries, highlighting that closing the VAT gap is as much about tax policy choices as it is about enforcement.

Source Aleksandra Bal

See also

VAT Gap in EU is 128 Billion EUR in 2023 – 27Bn EUR – VATupdate

Latest Posts in "European Union"

- ECJ VAT C-409/24 to C-411/24 – Judgment – Reduced VAT Rate Excludes Non-Accommodation Ancillary Services

- ECJ C-436/24 (Lyko Operations) – Judgment – Loyalty Points in Customer Reward Schemes Are Not VAT Vouchers

- ECJ C-472/24 (Žaidimų valiuta) – Judgment – VAT Exemption Denied for Virtual Money Transactions

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027