Based on the most visited posts of ECJ Cases on www.VATupdate.com in 2025

-

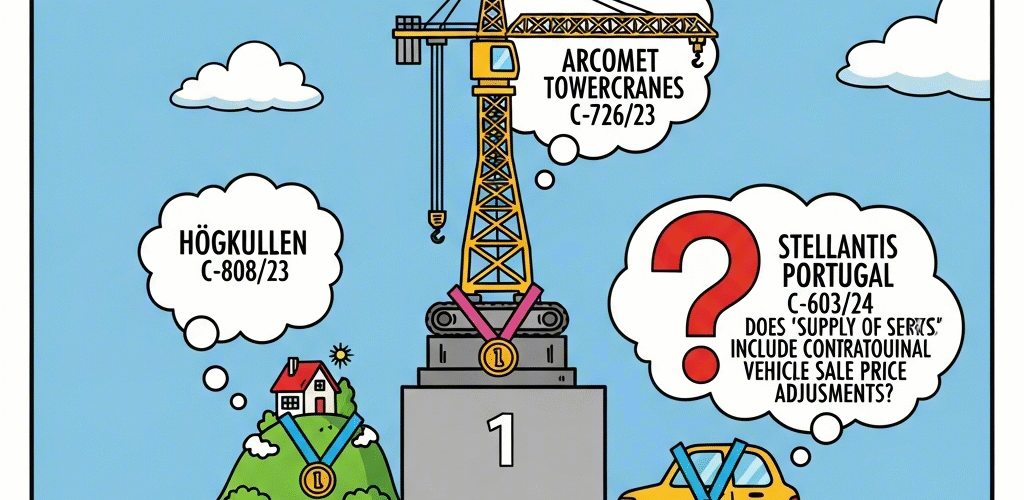

- C-726/23 (Arcomet Towercranes) – VAT and Transfer Pricing Adjustments on Intra-Group Services

- The ECJ held that transfer pricing adjustments between related companies — where services are defined contractually and linked directly to consideration — can be treated as a supply of services subject to VAT. Tax authorities may also ask for documentation beyond invoices to substantiate VAT deduction claims.

- C-808/23 (Högkullen) – Parent-subsidiary services cannot always be treated as a single supply

- The Court ruled that intra-group management services should not automatically be treated as a single supply for VAT purposes, allowing tax authorities to compare each component service against open market values when re-evaluating the VAT taxable amount.

- Not yet decided – C-603/24 (Stellantis Portugal) – Questions – Does “supply of services” include contractual vehicle sale price adjustments?

- The case involves a preliminary question to the CJEU on whether contractual vehicle sale price adjustments (e.g., for warranties/repairs) fall within the definition of “supply of services” for VAT purposes. This reference remains pending and is about legal interpretation rather than a final ruling.

- C-527/23 (Weatherford Atlas Gip) – Refusal of the right to deduct if services are not used for taxable transactions

- The CJEU ruled that a company cannot deduct input VAT on expenses for services not directly linked to taxable business activities. The right to deduction requires a clear and objective connection between the purchased services and taxable outputs. Since the costs related to non‑economic activities, the VAT deduction was rightly refused.

- C-232/24 (Kosmiro) – Factoring Fees Are Taxable Services Under EU VAT Law

- The Court confirmed that factoring services—including the management, collection and financing of receivables—constitute taxable supplies under EU VAT law. Such fees are not financial exemptions because they provide consideration for a specific service. The decision clarifies that operators charging commission for factoring must levy VAT, ensuring consistent treatment across Member States.

- C-639/24 (FLO VENEER) – VAT exemption cannot be denied due to missing specific evidence defined by Quick Fixes

- The Court held that Member States cannot deny a VAT exemption for intra‑EU supplies solely due to missing documentary evidence prescribed by “Quick Fixes” rules. If substantive conditions—such as actual cross‑border transport—are met, the exemption applies. The ruling strengthens VAT neutrality and proportionality over strict formal evidence requirements.

- C-640/23 (Greentech) – VAT deductions denied if VAT is not due but taxpayers can claim refunds directly

- The CJEU decided that VAT deductions are unavailable when VAT was wrongly charged but not due. Instead, the taxpayer must seek reimbursement of unduly paid VAT from the authorities directly, ensuring no financial loss. This reinforces proper VAT flow and prevents deduction claims over tax amounts not legally due.

- C-270/24 (Granulines Invest) – VAT deductions cannot be denied without proof of fraud or substantial evidence

- The Court ruled that tax authorities cannot automatically deny VAT deductions without concrete evidence of fraud or taxpayer negligence. Denial must be based on objective findings showing participation in, or awareness of, tax evasion. This judgment reinforces legal certainty and the principle of proportionality in VAT compliance enforcement.

- C-101/24 ( XYRALITY) – German developer is not liable for VAT on services via an app store

- CJEU held that developers distributing apps through digital platforms like app stores are not VAT‑liable for user transactions. The platform is considered the supplier, responsible for VAT collection and remittance. The ruling clarifies liability allocation within digital ecosystems, aligning with EU rules for electronic service intermediaries.

- C-436/24 (Lyko) – VAT on Loyalty Programs

- The Court clarified that loyalty program transactions—where customers redeem reward points for goods or services—constitute taxable supplies. VAT must be charged on the value represented by redeemed points. The decision harmonizes treatment of loyalty schemes across the EU, ensuring neutrality between cash and point‑based customer reward redemptions.

- C-726/23 (Arcomet Towercranes) – VAT and Transfer Pricing Adjustments on Intra-Group Services

See also

2. C-808/23 (Högkullen) – Parent-subsidiary services cannot always be treated as a single supply

5. C-232/24 (Kosmiro) – Factoring Fees Are Taxable Services Under EU VAT Law

9. C-101/24 ( XYRALITY) – German developer is not liable for VAT on services via an app store

10. C-436/24 (Lyko) – VAT on Loyalty Programs

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Briefing document & Podcast: EU VAT Directive 2006/112/EC Explained: ”VAT Rates” (Art. 93-129a)

- Briefing document & Podcast: EU VAT Directive 2006/112/EC Explained: ”Deductions” (Art. 167-192)

- Briefing document & Podcast: EU VAT Directive 2006/112/EC Explained: ”Exemptions” (Art. 131-166)

- Less Known Facts from the EU VAT Gap Report

- Briefing document & Podcast: EU VAT Directive 2006/112/EC Explained: The concept of ”Taxable persons” (Art. 9-13)