- €128 billion

- VAT compliance gap

- Amount of VAT legally due but not collected in 2023 due to non-compliance, insolvency, and administrative errors; +1.6 pp. compared to 2022

- €742 billion

- Actionable VAT policy gap

- VAT revenue foregone due to policy choices to apply VAT exemptions and reduced VAT rates.

- Full Report (PDF, 4.38 MB): Comprehensive country-by-country analysis on tax gaps across the EU

Download the full report [taxation-c….europa.eu] - Short Report (PDF, 454 KB): High-level overview of key findings and recommendations

Download the short report [taxation-c….europa.eu] - Methodological Note (PDF, ~176 KB): Explains methods used for estimating VAT, CIT, and other tax gaps

Download the methodological note [taxation-c….europa.eu]

Introduction

The Value Added Tax (VAT) is a significant source of revenue for both national and EU budgets. However, the disparity between the potential VAT revenue and the actual amount collected—known as the VAT gap—remains a pressing concern. The 2023 VAT Gap Report highlights critical issues related to VAT compliance and policy gaps across Europe, providing insights into the challenges facing EU Member States and candidate countries.

Key Findings of the 2023 VAT Gap Report

In 2023, the VAT compliance gap in the EU was estimated at €128 billion, representing 9.5% of the VAT Total Tax Liability (VTTL). This indicates an increase of 1.6 percentage points from the previous year. Despite this rise, there was a notable improvement from 2019, when the compliance gap stood at 11.1%.

In contrast, the actionable VAT policy gap, which reflects the revenue lost due to policy choices like exemptions and reduced rates, reached €742 billion, equating to 50.5% of the notional ideal VAT revenue. This marks a 0.6 percentage point increase from 2022.

VAT Compliance Gap

The VAT compliance gap refers to the difference between the potential VAT revenue that could be collected under full compliance and the actual amount collected. This gap arises from various factors, including:

- Non-compliance: Tax evasion and avoidance, often facilitated by loopholes in tax legislation.

- Administrative errors: Mistakes made during the VAT collection process.

- Bankruptcies: Insolvencies leading to the inability to pay VAT.

In 2023, the VAT compliance gap decreased in most EU Member States, with variations highlighting differences in compliance rates, tax administration effectiveness, and economic conditions.

VAT Policy Gap

The VAT policy gap encompasses revenue forgone due to reduced VAT rates and exemptions. The report outlines the actionable VAT policy gap, which can be attributed to choices made by national administrations and EU law. In 2023, the components of the actionable VAT policy gap included:

- VAT rate gap: Losses due to the application of reduced VAT rates.

- National policy-driven VAT exemption gap: Exemptions granted at the discretion of Member States.

- EU policy-mandated VAT exemption gap: Exemptions required by EU law.

The actionable VAT policy gap reached 50.5% in 2023, indicating a significant area for potential revenue recovery.

Regional Insights

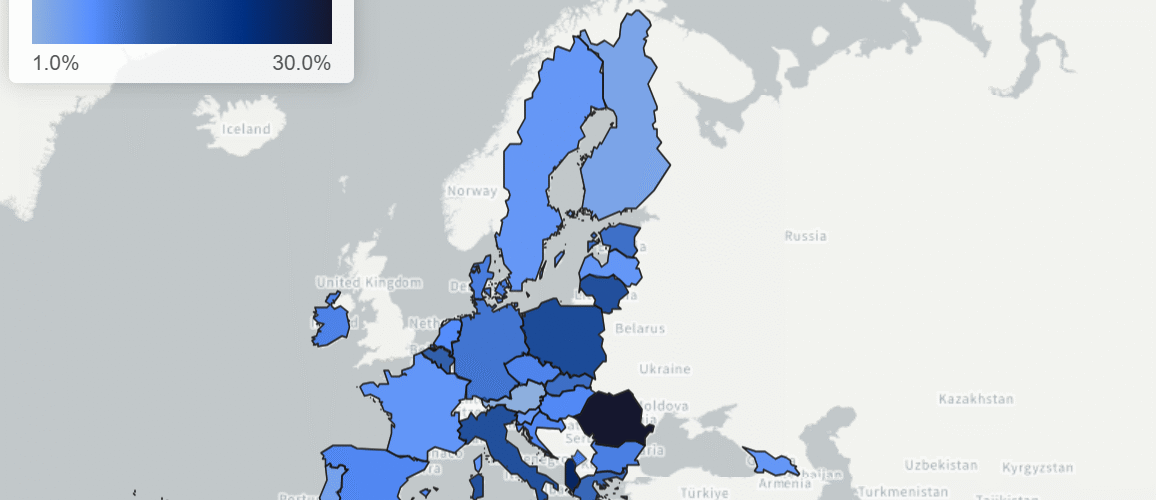

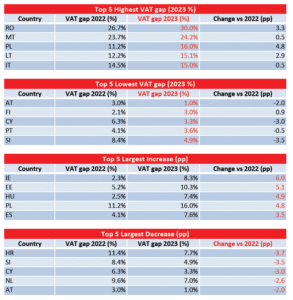

The report provides a detailed breakdown of VAT compliance and policy gaps across various EU Member States. Notable highlights include:

- Austria: Ranked first with a compliance gap of 1.0%, significantly lower than the EU average.

- Romania: Ranked last, with a compliance gap of 30.0%, indicating substantial challenges in VAT collection.

- Germany: Reported a compliance gap of 9.7%, reflecting ongoing issues despite being one of the largest economies in the EU.

Candidate Countries

The VAT gap estimates for EU candidate countries also reveal significant differences in compliance and policy gaps. For instance, Albania reported a compliance gap of 24.6%, while Georgia fared better at 5.4%.

Conclusion

The 2023 VAT Gap Report underscores the ongoing challenges of VAT compliance and policy effectiveness across Europe. As countries work to enhance tax compliance and optimize VAT policies, the findings serve as a crucial resource for identifying areas needing reform. Addressing the VAT gap not only improves public revenue but also ensures better funding for essential services such as healthcare and education.

Moving Forward

To effectively reduce the VAT gap, EU Member States and candidate countries must implement targeted measures aimed at improving compliance, revising tax policies, and enhancing the overall efficiency of tax administrations. By doing so, they can better harness the potential of VAT as a stable revenue source for public goods and services.

- Overall Tax Gap & Fraud Response: The European Commission’s “Mind The Gap” report reveals over EUR 100 billion in annual tax revenue losses across the EU, emphasizing tax gaps. It notes that while Eurofisc effectively identifies cross-border VAT fraud, national administrative measures are often too slow to invalidate VAT numbers and stop fraudulent transactions.

- VAT Compliance and Policy Gaps: In 2023, the EU’s VAT compliance gap, the difference between potential and collected VAT, stood at an estimated EUR 128 billion (9.5% of GDP), having increased recently. The VAT policy gap, resulting from reduced rates and exemptions, was estimated at EUR 1.4 trillion, with differentiation and national exemptions accounting for roughly EUR 650 billion.

- Improving Collection & Future Initiatives: The report suggests improving tax collection through better-maintained VAT databases for quicker data analysis and compliance checks. The upcoming ViDA initiative is expected to introduce digital reporting and e-invoicing, paving the way for pre-filled VAT returns, a feature currently offered by only seven Member States.

Source Cesar Atroshy

See also vatcalc

Latest Posts in "European Union"

- Ecofin report on EU VAT reforms

- Roadtrip through ECJ cases: Focus on Promotional activities/Discounts (Art. 79, 87, 90(1))

- Comments on ECJ case C-234/24 (Brose Prievidza): No VAT Exemption for Tooling Without Physical Movement

- Roadtrip through ECJ Cases – Focus on “Liability to pay VAT – Jointly and severally liability of the payment of VAT” (Art. 205)

- ECJ Customs – C-488/24 (Kigas) – AG Opinion – Traders must inform consumers about customs duties before contracts