Who, What, When

Issued by: Inland Revenue Board of Malaysia (IRBM)

What: Release of Malaysia e-Invoice Guide Version 4.6

When: 7 December 2025

The Inland Revenue Board of Malaysia (IRBM) has published Version 4.6 of the e-Invoice Guideline, introducing significant updates to support businesses in transitioning to electronic invoicing under the country’s digital tax compliance framewo

✅ 1. Expanded Scope of Transactions

- Added self-billed invoices and clarified rules for credit/debit notes.

- Clearer treatment for cross-border transactions and foreign suppliers.

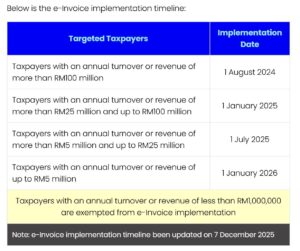

✅ 2. Updated Implementation Timeline

- Revised phased rollout dates by annual turnover.

- Additional grace periods for SMEs and micro businesses.

✅ 3. New Exemption Threshold

- Taxpayers with annual turnover below RM 1,000,000 are exempt from mandatory e-Invoice implementation.

- These taxpayers can opt-in voluntarily via MyInvois Portal.

✅ 4. Enhanced MyInvois Portal Features

- New dashboard and reporting tools.

- Improved error handling and rejection notifications.

✅ 5. API Specification Updates

- New API endpoints for real-time validation and cancellation.

- Mandatory OAuth 2.0 authentication for all API integrations.

✅ 6. Validation & Compliance Rules

- Stricter checks on mandatory fields (e.g., TIN, invoice date).

- Updated rules for invoice cancellation and rejection scenarios.

✅ 7. Exemptions and Special Cases

- Clearer guidelines on exempted sectors and non-taxable transactions.

- Additional provisions for government-related transactions.

✅ 8. Visual Representation

- Standardized QR code format for e-Invoices.

- Updated sample layouts for printed representations.

Latest Posts in "Malaysia"

- Procedures for Invoicing and SST-02 Declarations: 2% Service Tax Exemption on Rental Services

- Service Tax Exemptions for Rental and Leasing Services: Key Amendments Effective January 2026

- RMCD Issues Updated Service Tax Guide for Brokerage and Underwriting Services Effective July 2025

- Malaysia Limits Vehicle Tax Exemptions in Langkawi, Labuan to Cars Under MYR 300,000

- Service Tax Exemption for Construction and Renovation of Places of Worship Effective July 2025