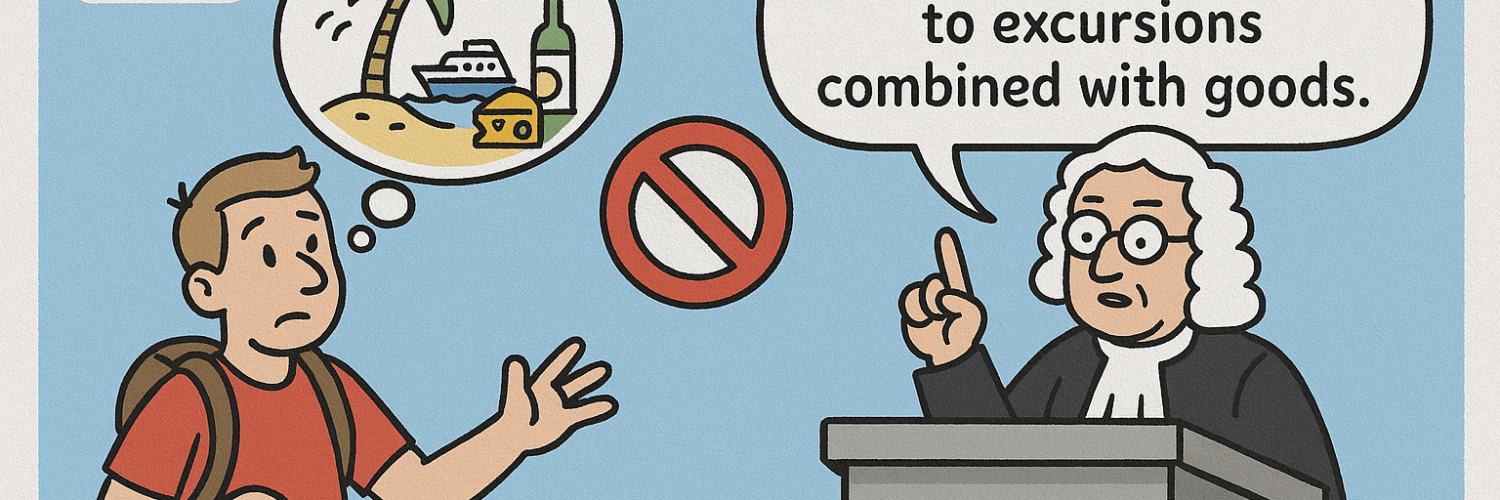

- Advocate General’s Conclusion: Advocate General Szpunar determined that the travel agency scheme does not apply to P GmbH’s “Kaffeefahrten,” as the activities of travel agencies should not be interpreted as organizing trips in conjunction with the supply of goods.

- Nature of P GmbH’s Operations: P GmbH organizes coach excursions where participants can purchase goods during commercial events, but the trips primarily facilitate these sales rather than being standalone travel services. The transport costs are not included in the fees paid by participants.

- Tax Implications: The AG’s interpretation implies that since the fees do not cover the full costs of transport services and are linked to the sale of goods, P GmbH’s entire activity should be taxed under the general VAT scheme rather than benefiting from the travel agency scheme provisions.

Source Taxlive

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights

- EU ViDA E-Invoicing: Key Changes and Luxembourg Implications for Cross-Border B2B Transactions