This briefing document reviews the key aspects of the Collée v. Finanzamt case (C-146/05) concerning VAT exemptions for intra-Community supplies within the European Union. The case explores the tension between Member States’ rights to prevent tax evasion and the principle of fiscal neutrality.

I. Core Issues & Themes

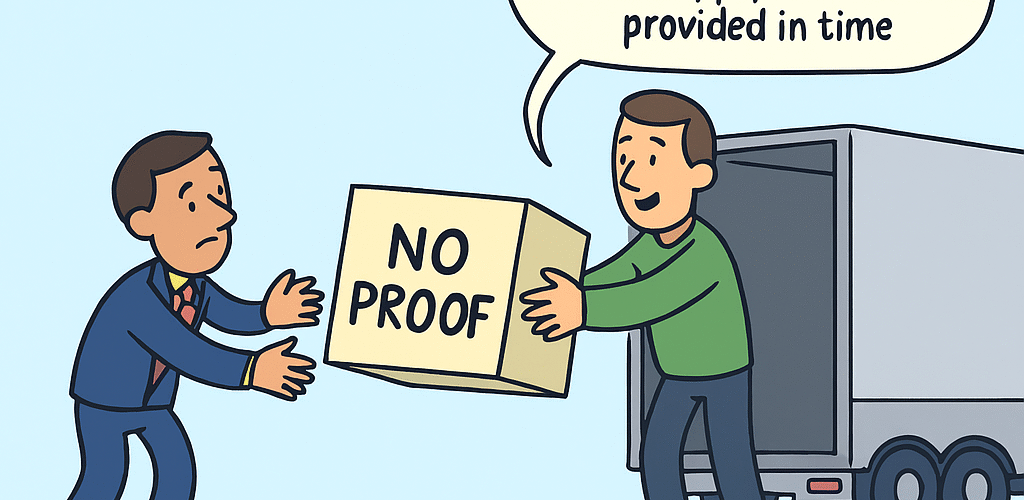

- The Central Question: Can a Member State deny a VAT exemption for an intra-Community supply that demonstrably occurred, solely because the taxable person did not produce the prescribed accounting evidence in a timely manner? As stated in the “VAT Exemption Study Guide,” the central legal question is: “whether a Member State can refuse to grant a VAT exemption for an intra-Community supply that undoubtedly occurred, solely because the taxable person did not produce the prescribed accounting evidence in good time.”

- Article 28c(A)(a) of the Sixth VAT Directive: This article mandates that Member States must exempt supplies of goods transported between Member States under certain conditions. “Article 28c(A)(a) mandates that Member States must exempt supplies of goods that are dispatched or transported from one Member State to another, by or on behalf of the vendor or the purchaser, provided the supply is made to another taxable person or a non-taxable legal person acting as such in another Member State.”

- Formal vs. Substantive Requirements: The Court distinguishes between formal requirements (timely documentation, strict procedural adherence) and substantive requirements (actual conditions like transport of goods to another Member State). As the “VAT Exemption Study Guide” explains, “The distinction is important because the Court ruled that denying an exemption based solely on failure to meet formal requirements (like timely documentation) is disproportionate if the substantive requirements for the exemption (that an intra-Community supply actually occurred) are met. “

- Principle of Proportionality: Measures taken by Member States to ensure correct VAT collection must not go beyond what is necessary to achieve that objective. This prevents excessively burdensome formal requirements from undermining the right to a VAT exemption when the supply clearly occurred. “The principle of proportionality dictates that measures taken by Member States to achieve a specific objective (like ensuring correct VAT collection) must not go beyond what is necessary to achieve that objective.”

- Principle of Fiscal Neutrality: VAT should be applied in a way that does not distort competition and that similar transactions are taxed similarly. Overly strict formal requirements can unfairly penalize taxable persons engaged in genuine intra-Community trade, thus distorting competition. “The principle of fiscal neutrality ensures that VAT is applied in a way that does not distort competition and that similar transactions are taxed similarly.”

- Risk of Tax Evasion/Loss of Tax Revenues: The Court considers whether failure to comply with formal requirements creates a risk of tax evasion or loss of tax revenues for the Member State.

- Good Faith vs. Bad Faith: The Court considers the “good faith” of the taxable person relevant only if there is a risk of lost tax revenue. If the taxable person conceals a transaction, the national court should examine if this concealment could lead to a loss in tax revenues and if that risk has been eliminated. “The Court considers the good faith of the taxable person relevant if there is a risk of a loss in tax revenues.”

II. Key Facts of the Collée Case

- Collée KG (later Mr. Collée) was involved in an intra-Community supply of cars to a Belgian dealer.

- Initially, the transaction was structured as a sham sale to a German dealer to circumvent territorial restrictions on commission.

- After a tax investigation, Collée corrected the accounting records, claiming an exemption for the intra-Community supply.

- The German tax authorities (Finanzamt) denied the exemption because the records were not updated promptly after the transaction.

- The case reached the Bundesfinanzhof (Federal Fiscal Court), which referred it to the CJEU for a preliminary ruling.

III. CJEU Ruling & Key Takeaways

- Ruling: The Court ruled that a Member State cannot deny a VAT exemption for an intra-Community supply solely because the evidence was not produced in a timely manner. The actual ruling stated: “The first subparagraph of Article 28c(A)(a) of Sixth Council Directive 77/388/EEC… must be interpreted as precluding the refusal by the tax authority of a Member State to allow an intra-Community supply – which actually took place – to be exempt from value added tax solely on the ground that the evidence of such a supply was not produced in good time.”

- Emphasis on Substantive Requirements: The exemption should be granted if the substantive requirements are met, unless the failure to comply with formal requirements prevents conclusive evidence that the substantive requirements were fulfilled.

- Good Faith & Risk of Tax Loss: The national court should consider the taxable person’s initial concealment of the supply only if there’s a risk of lost tax revenue that hasn’t been eliminated. “When examining the right of exemption from value added tax in relation to such a supply, the referring court should take into account the fact that the taxable person initially knowingly concealed the fact that an intra-Community supply had occurred only if there is a risk of a loss in tax revenues and that risk has not been wholly eliminated by the taxable person in question.”

- Preventing Abuse, but Proportionately: Member States can impose penalties for tax evasion, but these penalties must be proportionate to the gravity of the abuse.

- Documentation Still Required: The ruling does not mean businesses can ignore documentation requirements. Member States can impose reasonable obligations to ensure proper tax collection and prevent fraud. However, denying an exemption solely based on a delay or technicality in providing documentation is disproportionate if the substantive requirements are met and there is no risk of tax loss.

IV. Implications for Businesses

- Compliance remains essential: Businesses must maintain proper documentation for VAT exemptions.

- Timeliness is important: While a delay in providing evidence alone is not grounds for denial, timely record-keeping is still best practice.

- Substance over Form: The ruling emphasizes the importance of demonstrating that the intra-Community supply actually occurred.

- Transparency is Key: If errors or omissions occur, businesses should correct them transparently and without attempting to conceal the transaction.

- Proportionate Penalties: Any penalties imposed for non-compliance must be proportionate to the severity of the infraction.

V. Conclusion

Collée v. Finanzamt clarifies the balance between Member States’ powers to enforce VAT regulations and the fundamental principles of EU VAT law, particularly the principle of fiscal neutrality. The case confirms that while proper documentation is necessary, denying a VAT exemption based solely on a delay in providing evidence is disproportionate if the substantive requirements for the exemption are met and there is no risk of tax loss. Businesses should prioritize compliance with VAT regulations, but they also have the right to a fair assessment of their claims based on the objective facts of the transaction.

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- EDPS Opinion on EPPO and OLAF Access to VAT Data for Combating EU Fraud

- EU Agrees on Temporary €3 Customs Duty for Low-Value E-Commerce Parcels from July 2026

- New InfoCuria case-law database and search tool

- New General Court VAT case – C-903/25 (Grotta Nuova) – No details known yet

- New General Court VAT case – C-914/25 (Modelo Continente Hipermercados) – No details known yet