- The 7% VAT rate in Ukraine supports key social and strategic sectors like healthcare, energy, and culture.

- It applies to medicines and medical devices approved for use in Ukraine.

- It covers services related to natural gas, thermal energy, hot water, and centralized heating.

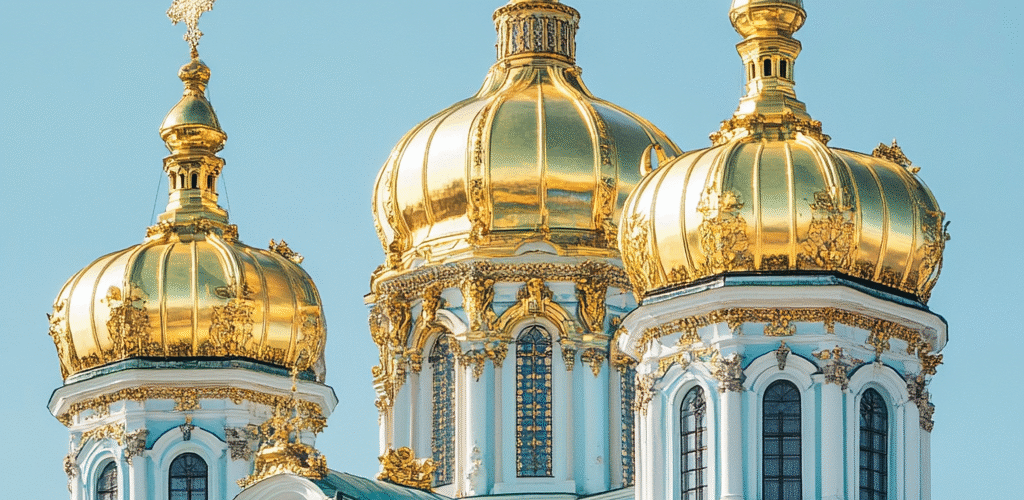

- Certain cultural, tourism, and transport services (e.g., passenger air transport, tourist trips, cultural events) are also included if approved by the Cabinet of Ministers.

- The reduced rate aims to make these goods and services more accessible to the population.

Source: news.dtkt.ua

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Ukraine"

- Purchasing Goods from Non-VAT Payers: How to Fill in the Data Table Correctly

- Ukraine to Reinstate Taxes on Electric Vehicles in 2026: Impact on Prices and Market Explained

- Ukraine Proposes Easier Tax Inspections, Raises VAT Thresholds for Small Businesses

- Are Medical Examination Services Subject to VAT in Ukraine? Taxation Rules and Exemptions Explained

- VAT Successor’s Right to Tax Credit After Reorganization: Key Points and Restrictions