This briefing document summarizes the key aspects of Mexico’s electronic invoicing (CFDI) and real-time reporting system based on the provided sources.

1. Overview and Implementation Timeline:

Mexico is a pioneer in electronic invoicing. The initial system (CFD) was introduced in 2004, followed by the internet-based CFDI system in 2011. “As of January 1, 2014, electronic invoicing is mandatory for all taxpayers in Mexico.” This mandate encompasses all transaction types: ” B2B, B2C, and B2G (business-to-government), as well as cross-border sales and purchases.” The system has been continuously updated, with major upgrades to CFDI version 3.3 in 2017 and the latest CFDI 4.0 becoming mandatory from July 1, 2023. In addition to e-invoices, ” “Contabilidad Electrónica” (electronic accounting) from 2015 , requiring companies to electronically report accounting data (chart of accounts, trial balances, etc.) on a monthly basis in prescribed XML format” was introduced.

2. Scope and Taxpayers:

Mandatory e-invoicing applies to ” Virtually all taxable persons in Mexico.” This includes corporations (” personas morales “), sole proprietors and freelancers (” personas físicas “), and even government entities issuing invoices. There are ” no general exemptions based on business size or revenue.” The only exception is for certain foreign digital service providers selling into Mexico, who are not required to issue local CFDI invoices under a special VAT regime.

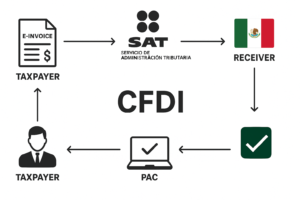

3. Data and Reporting Requirements (Clearance Model):

Mexico uses a ” clearance model “, meaning ” invoice data must be transmitted to the tax authority (SAT) in real time for approval.” A CFDI must be prepared in XML format and ” sent to an authorized certification provider (PAC) or directly to SAT to be validated and stamped before it is considered a legal invoice.”

Key required data fields include:

- Seller’s and buyer’s RFC (tax identification number) and names.

- Seller’s fiscal regime.

- Date and time of issuance.

- Unique invoice folio number.

- The digital signature (SELLO) of the issuer and the digital stamp from SAT/PAC (UUID).

- Items or services detail (quantity, unit of measure, description, unit price).

- Tax amounts (VAT breakdown by rate, any withheld taxes) and total amount.

- Payment method (e.g., paid in full or partial).

A “complemento” (data complement) is required for certain transactions, providing additional information (e.g., foreign trade details for exports, transport waybill). All issued CFDI invoices must be stored electronically in XML format for at least 5 years.

4. Deadlines for Submission:

“E-invoices must be submitted and timestamped very quickly around the time of the transaction.” A CFDI must be sent to the SAT (via a PAC) ” no later than 24 hours after the underlying sale or transaction.” In practice, invoices are often issued and approved in real-time at the point of sale. Monthly electronic accounting reports must be uploaded to SAT’s portal by the 25th day of the following month. The “DIOT” (Declaración de Operaciones con Terceros), a monthly summary of VAT on purchases from each supplier, is due by the 17th of the following month.

5. Formats and Technology:

The standard e-invoice format is ” CFDI (Comprobante Fiscal Digital por Internet).” It’s a structured ” XML file ” defined by the SAT’s schema. ” XML is the required format ” for submissions. The XML must carry the issuer’s ” digital signature certificate (SELLO) ” and receive the ” SAT/PAC digital stamp (UUID) ” after clearance. While a PDF or printed copy can be provided, ” the XML data file is the legally valid invoice.” Other e-reporting obligations also use standardized digital formats, primarily XML.

6. Penalties for Non-Compliance:

” Failure to comply with Mexico’s e-invoicing and reporting requirements can result in significant penalties.” “Not issuing a required CFDI invoice, or issuing it with missing/incorrect information, is subject to fines ranging roughly from MXN $19,700 up to $112,000 per instance.” ” Omitting a mandatory “complement” data on an invoice can incur a fine of $400–$600 MXN per invoice.” Repeated offenses can lead to temporary business closure. ” Deliberate issuance of fake invoices or failure to report revenue via CFDI can be pursued as tax fraud or smuggling crimes.”

7. Pre-Filled VAT Returns:

As of ” 2024 , SAT has begun to leverage e-invoice data to preload information in monthly VAT returns for taxpayers.” Taxpayers see ” a draft VAT return with preloaded figures” based on CFDI invoices. Taxpayers can review and adjust the prefilled data, but remain responsible for accuracy. ” Mexico now provides a form of pre-filled VAT return using e-invoice information, to simplify compliance.” This does not replace the obligation to file.

8. Key Terms:

- CFDI (Comprobante Fiscal Digital por Internet): The standard electronic invoice format in Mexico.

- SAT (Servicio de Administración Tributaria): Mexico’s tax authority.

- PAC (Proveedor Autorizado de Certificación): An authorized certification provider that validates e-invoices on behalf of the SAT.

- RFC (Registro Federal de Contribuyentes): The Mexican tax identification number.

- XML (Extensible Markup Language): A standardized digital format used for e-invoice submissions.

- SELLO: The issuer’s digital signature certificate.

- UUID (Universally Unique Identifier): The digital stamp received from the SAT or PAC after an invoice has been validated.

- Complemento: A data complement added to an invoice to provide additional information for specific types of transactions.

- Contabilidad Electrónica: Electronic accounting.

- DIOT (Declaración de Operaciones con Terceros): A monthly summary of VAT on purchases from each supplier.

- Personas Morales: Corporations.

- Personas Físicas: Sole proprietors and freelancers.

INDEPTH ANALYSIS

Sources

- CFDI – Electronic Invoicing in Mexico – VATupdate

- Electronic Invoicing in Mexico: CFDI 4.0 and Recent Updates

- Mexican RFC: Your Complete Guide – VATupdate

- E-Invoicing in Mexico – VATupdate

- See also

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

Latest Posts in "Mexico"

- Mastering Mexico CFDI 4.0: Simplified Compliance and Strategies for 2026 E-Invoicing Success

- Mexico Publishes List of Taxpayers Accused of Issuing Invalid Invoices in Official Gazette

- SAT Warns: Over 100,000 Peso Fines for Improper CSF Requests in Electronic Invoicing

- Mexico Expands VAT and Tax Withholding Rules for Digital Platforms to Legal Entities from 2026

- Mexico Publishes List of VAT-Compliant Nonresident Digital Platforms in Official Gazette, Jan. 30, 2026