- The previous position on “Revaluation of the tax base for staff meals in restaurant companies” is no longer applicable as of 2025-10-28.

- Information regarding the tax base for staff meals has been updated.

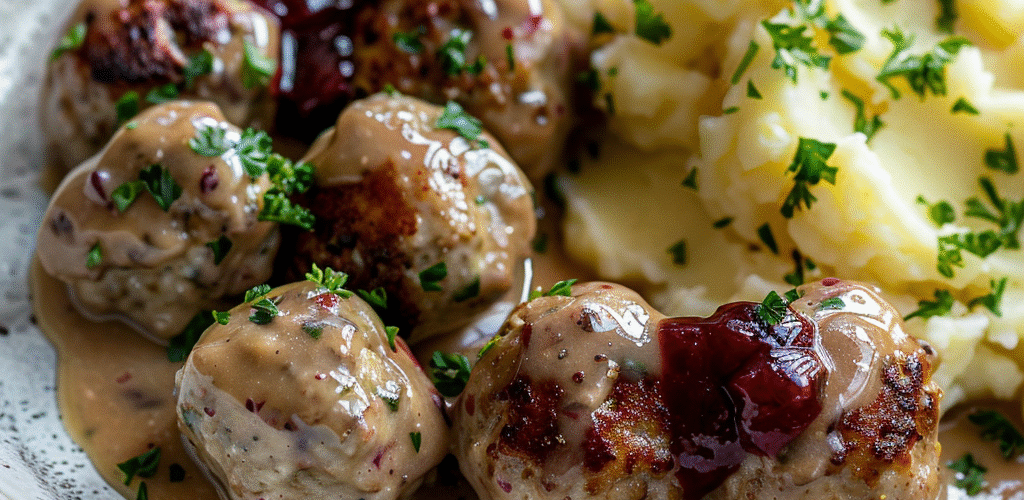

- Staff meals provided under collective agreements are not comparable to restaurant services offered to customers.

- If staff pay at least the company’s cost for the meal, that payment is considered market-based and is used as the tax base.

- If staff pay less than the company’s cost, the tax base is set at the company’s actual cost for providing the meal, requiring a revaluation according to 8 kap. 17 § ML.

Source: www4.skatteverket.se

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Sweden"

- Reassessment Statement on Tax Base for Staff Meals in Restaurants No Longer Applies

- Clarification: Who Qualifies as a Transport Operator According to the Swedish Tax Agency

- Taxation of Criminal Activities: Income and VAT Implications for Individuals under Swedish Law

- Sweden Clarifies Input VAT Apportionment Rules for Mixed Activities in New Guidance

- Sweden Clarifies Input VAT Apportionment Rules for Mixed Activities in New Tax Agency Statement