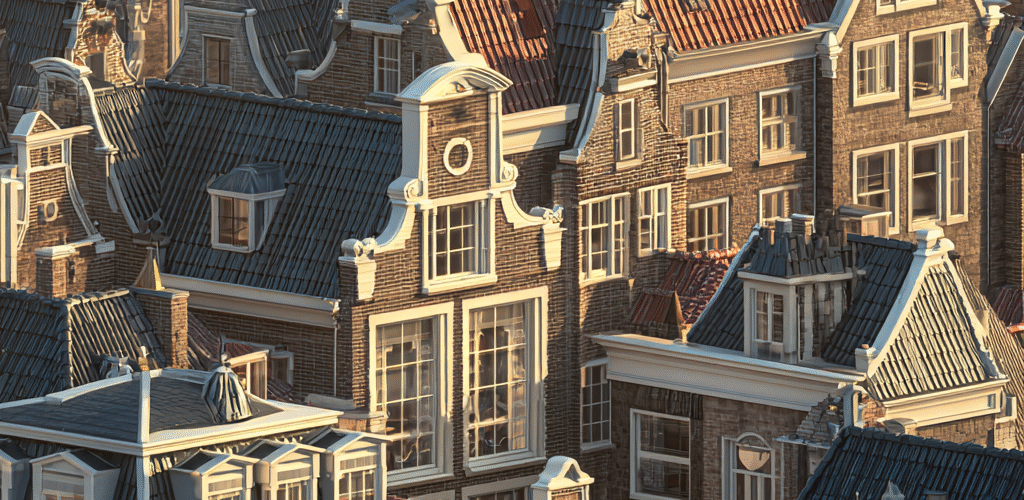

The renovation of two monumental buildings into a hotel was not deemed the production of a new good under the VAT Act. This is because the structural modifications were too limited, as essential construction elements like the roof, floors, stairs, and lifts were not replaced. Despite the high investment costs and the change of function from office to hotel, the court ruled it did not essentially constitute new construction. The court confirmed that only radical changes to the building’s structure can lead to a newly produced good, resulting in the denial of the VAT exemption and the request for transfer tax refund.

Source: fiscaalvanmorgen.nl

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Netherlands"

- Netherlands Raises VAT on Short-Stay Accommodation to 21% Effective January 2026

- Hospice performance does not qualify as exempt service or short stay

- Assessment of Dispute: Single or Multiple Services in Hospice Guest Care and Tax Implications

- Netherlands Suspends €2 Handling Fee on Non-EU Parcels, Awaits EU Customs Measures in 2026

- Decision on the introduction of a national handling fee postponed