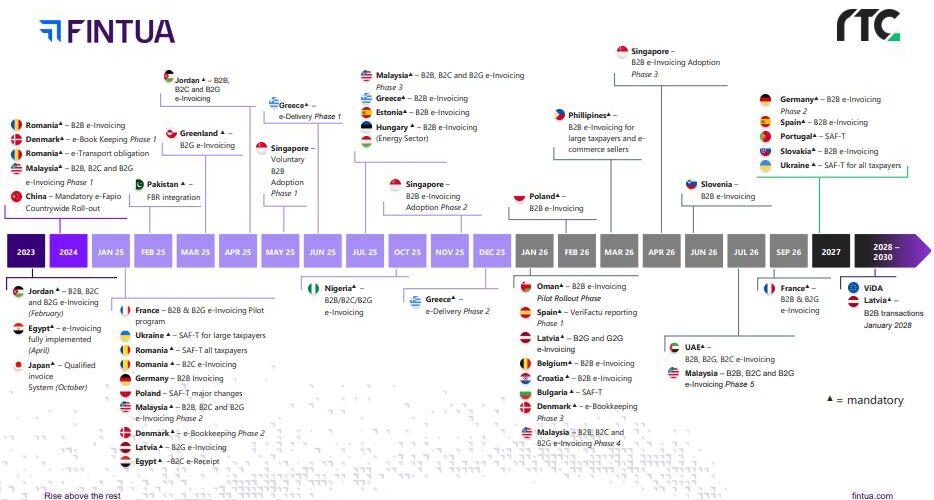

Governments from France and Germany to Malaysia and the UAE are rolling out new e-invoicing mandates — with major changes landing every quarter through 2026.

As regulatory timelines accelerate, finance and tax teams are under pressure to rethink their compliance frameworks and digital readiness.

Explore what’s changing and how to stay ahead: Click HERE

Visit us: Click HERE

Book directly with Fintua: Click HERE

Visit us: Click HERE

Book directly with Fintua: Click HERE

#EInvoicing #VATCompliance #DigitalTransformation #Fintua

Click on the logo to visit the website

Subscribe to the FINTUA Newsletter

Click on the logo to visit the website

- See also

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

- Join the LinkedIn Group on ”VAT in the Digital Age” (VIDA), click HERE

Latest Posts in "World"

- VAT as digital infrastructure: why the next phase requires Trust 4.0

- Why Chatbots Don’t Solve VAT Compliance

- Top 5 Indirect Tax Trends from SYNAPSE 2026: AI, Real-Time Compliance, Automation, and Data

- Centralizing Global Hospitality Compliance: Streamlining E-Invoicing and Tax Reporting Across Regions

- Top 7 e-Invoicing Compliance Solutions for Global VAT in 2026: Features and Selection Guide