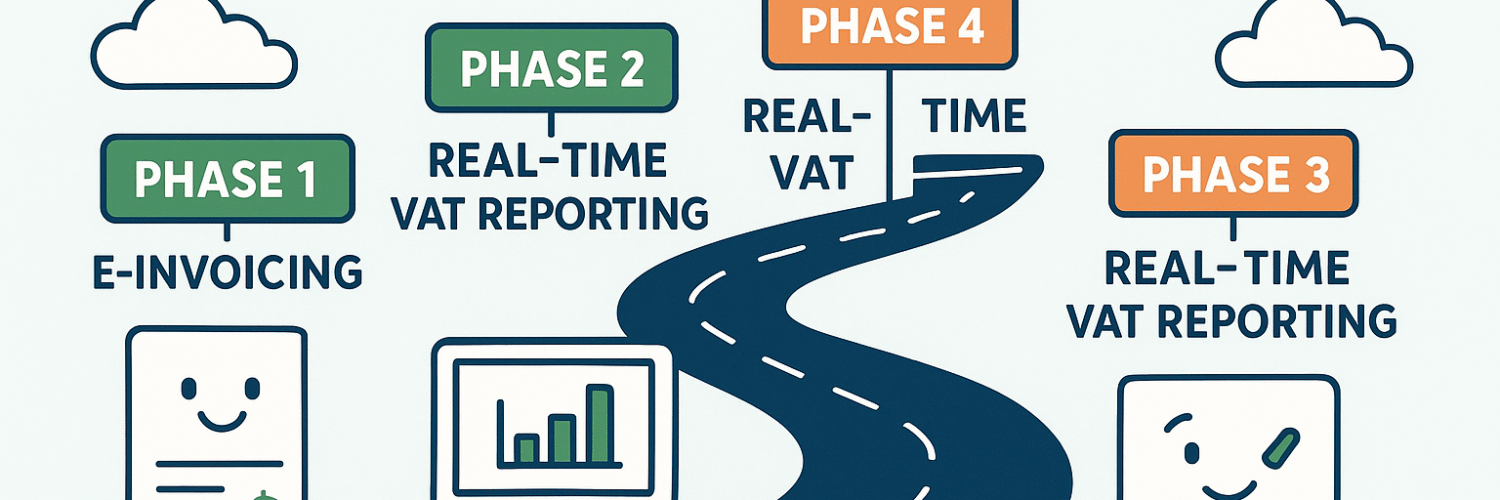

Ireland’s ViDA Roadmap: Phased Rollout of E-Invoicing & Real-Time VAT Reporting

Phase 1 – November 2028

- All businesses must be able to receive structured e-invoices.

- Mandatory e-invoicing and real-time reporting begins for large VAT-registered corporates involved in domestic B2B transactions.

- These businesses are expected to have the digital capacity and international experience to adapt early.

Phase 2 – November 2029

- Mandatory e-invoicing and real-time reporting expands to all VAT-registered businesses engaged in intra-EU cross-border B2B transactions.

- This phase ensures alignment with the EU’s goal of harmonized digital VAT compliance.

Phase 3 – July 2030

- Full implementation of ViDA requirements for all cross-border EU B2B transactions, regardless of business size.

- Structured e-invoices must comply with European Standard EN16931, and PDF or scanned invoices will no longer be accepted.

Technical & Legislative Preparations

- Ireland will leverage the PEPPOL framework for secure and standardized e-invoice exchange.

- Revenue is working on legislative changes, IT systems, and stakeholder engagement to support the transition.

- Guidance and technical specifications will be published ahead of each phase to ensure smooth onboarding.

Strategic Goals

- Modernize Ireland’s VAT system, which has remained largely unchanged since 1972.

- Reduce compliance burdens and enhance fraud prevention.

- Align with international best practices and support business digitalization.

Source revenue.ie

Ireland’s Invoice to Compliance Journey: Mandatory e-Invoicing and VAT Reporting under ViDA

- Ireland is implementing a phased rollout of mandatory e-invoicing and real-time VAT reporting, starting November 2028, to align with the EU’s VAT in the Digital Age (ViDA) Directive by July 1, 2030.

- This initiative aims to modernize VAT administration, combat fraud, and reduce compliance costs by requiring structured electronic invoices (EN16931 compliant) and real-time transaction data reporting, utilizing existing Peppol infrastructure.

- All VAT-registered businesses will be affected, with a key milestone requiring all to be capable of receiving e-invoices by November 2028, followed by mandatory issuance for large corporates (Nov 2028), all intra-EU traders (Nov 2029), and finally all cross-border EU B2B transactions (July 2030).

Source VAT IT

Click on the logo to visit the website

Ireland’s Roadmap for ViDA: Revenue Sets phased B2B e-Invoicing and Real-time VAT Reporting

- Phased Implementation Plan: Ireland’s Revenue announced a three-phase rollout for mandatory e-invoicing and real-time VAT reporting, starting November 2028 for large corporates and culminating in July 2030 for all cross-border EU B2B transactions.

- Alignment with EU ViDA: The implementation plan aligns with the EU’s VAT in the Digital Age (ViDA) package, adopted in March 2025, ensuring Ireland meets the July 2030 deadline for digital reporting and e-invoicing across the EU.

- Business Readiness and Compliance: All businesses must be ready to receive e-invoices by November 2028, while the phased approach aims to enhance operational efficiency, reduce manual processing, and combat VAT fraud through improved data integrity and reporting.

Source RTCsuite

Click on the logo to visit the website

E-Invoicing in Ireland – Compliance, VAT & Digital Tax (KPMG.ie)

- Phased Implementation Plan: Ireland’s tax authority announced a three-phase rollout for mandatory e-invoicing and real-time VAT reporting to comply with the EU ViDA Directive by July 1, 2030, starting with large corporates in November 2028.

- Structured e-Invoice Formats: The new system will require structured e-invoice formats compliant with European Standard EN16931, replacing traditional methods like PDFs or scanned invoices, to improve VAT compliance.

- Support and Guidance: Revenue is collaborating with stakeholders and will provide detailed guidance and technical specifications to ensure smooth implementation, aiming to reduce compliance burdens and enhance competitiveness in VAT administration.

Ireland Announces Phased E-Invoicing and Real-Time Reporting Implementation by 2030

- Ireland announced plans to implement mandatory eInvoicing and real time reporting in three phases to comply with EU VAT in the Digital Age Directive by July 2030

- Phase 1 starts November 2028 for large corporate entities with domestic B2B transactions, Phase 2 extends to all VAT registered businesses with cross border EU B2B trading in November 2029, and Phase 3 covers all cross border EU B2B transactions from July 2030

- All businesses must be able to receive eInvoices from November 2028 regardless of whether they are required to issue them under the phased rollout

- The system will follow EU e invoicing standard EN 16931 and use the Peppol network for structured invoice exchange

- This represents a significant change that will digitalize business processes and provide tools to combat VAT fraud

Source: meridianglobalservices.com

Introduction of Domestic B2B E-Invoicing

- Phased Rollout of E-Invoicing: Ireland’s Finance Minister announced a phased implementation of a domestic B2B e-invoicing mandate, aligning with the EU’s ViDA package to modernize VAT administration and enhance compliance.

- Implementation Timeline: The rollout will occur in three phases: starting with large corporates in November 2028, followed by all VAT-registered businesses engaged in intra-EU trade by November 2029, and concluding with full compliance for all intra-EU B2B transactions by July 2030.

- Technical Compliance and Infrastructure: E-invoices must comply with European Standard EN 16931, utilizing structured data formats for automatic processing, and will leverage existing infrastructures like the PEPPOL framework, with further guidance and support from Revenue for affected businesses.

Source Sovos

Ireland Releases Roadmap for Domestic B2B E-Invoicing and Real-time Reporting Implementation

Ireland has outlined a roadmap to implement the EU’s VAT in the Digital Age (ViDA) requirements, beginning a phased rollout in November 2028 for large corporations. The plan will gradually expand, requiring all VAT-registered businesses in intra-EU trade to comply by November 2029, and achieving full EU compliance by July 2030. These sweeping changes, which mandate e-invoicing and real-time reporting, will significantly impact Irish businesses across multiple departments, necessitating immediate review and preparation of ERP systems and invoicing software.

Source: bdo.global

- See also

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

Latest Posts in "Ireland"

- Ireland Confirms Large Corporates for Phase One of Mandatory B2B e-Invoicing and VAT Modernisation

- 9% VAT Rate for Residential Apartments and Blocks Under Finance Act 2025: Key Provisions Explained

- Ireland’s New E-Invoicing Regime: PEPPOL, EN 16931, and Preparing for Digital VAT Compliance

- Ireland Confirms Phased Rollout of Mandatory E-Invoicing and Real-Time VAT Reporting from 2028

- Ireland’s VAT Modernisation: Large Corporates Must Issue Structured E-Invoices for B2B from 2028