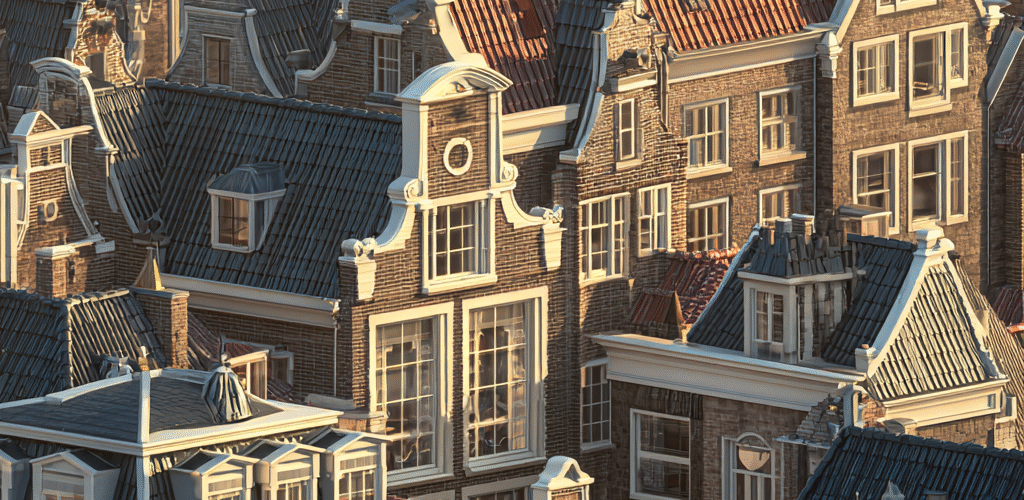

- New VAT Rules Implementation: Effective January 1, 2026, new VAT regulations in the Netherlands will increase the administrative burden for entrepreneurs, particularly impacting high-cost services related to renovations of immovable property, with the aim of leveling the playing field and aligning VAT deductions with long-term usage.

- Extended VAT Adjustment Period: Entrepreneurs will need to monitor VAT deductions for renovations for up to four years after commissioning, requiring adjustments if the use of the service changes from VAT-taxable to VAT-exempt, with a minimum service cost threshold of EUR 30,000 to avoid managing multiple adjustment periods for smaller projects.

- Preparation and Compliance: Businesses should proactively identify applicable services, assess their internal processes for tracking VAT use, and consider completing renovations before January 1, 2026, to avoid the new obligations; proper preparation is essential to mitigate undesirable VAT consequences.

Source BDO

Latest Posts in "Netherlands"

- Government Responds to Questions on VAT Increase Impact Analysis for Accommodation

- Heijnen Maintains VAT Increase on Accommodation Despite Predicted Revenue Loss

- VAT due to number acquisition not deductible due to participation in fraud

- Dutch Government Responds to Questions on Reduced VAT for Culture Media Sports

- Court Rules Sale-and-Leaseback Property Transfer Not Exempt from Transfer Tax