Last update: October 5, 2025

Relevance of art. 32 of the EU VAT Directive 2006/112/EC

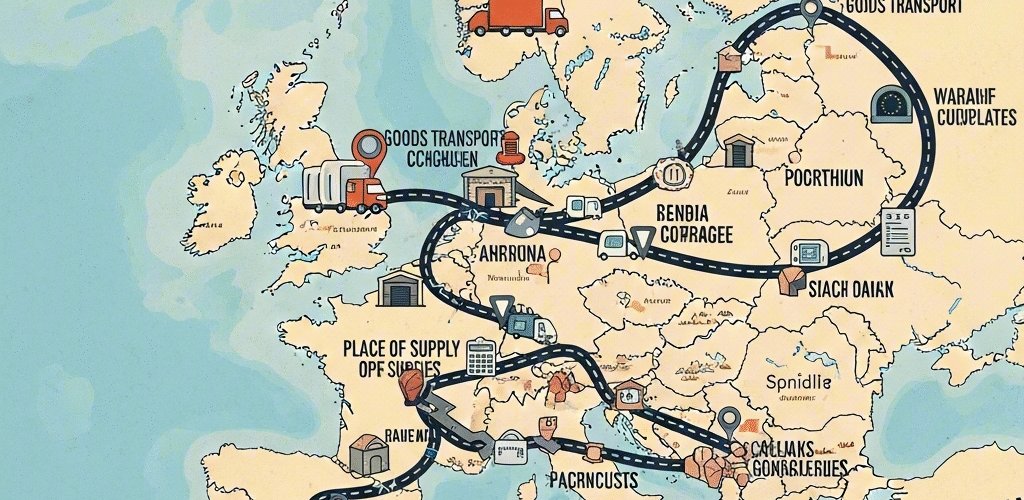

Article 32 governs the “place of supply of goods” in cases of chain supplies, where goods are delivered through a series of interconnected transactions involving multiple parties. Correct interpretation of this article is crucial for determining which EU Member State has the right to tax the supply and which VAT rules apply, especially in complex cross-border supply chains.

The importance of Article 32 lies in:

- Providing clarity on how to allocate VAT liability correctly in multilayered transactions, avoiding double taxation or VAT evasion gaps.

- Defining whether the supply is treated as domestic or intra-community for VAT purposes, impacting the VAT treatment such as zero-rating for exports or intra-community acquisitions.

- Ensuring consistent VAT treatment across Member States for chain transactions, reducing litigation and disputes.

- Facilitating compliance for businesses operating in complex supply chains, enabling better planning and administration.

- Being a frequent subject of European Court of Justice (ECJ) rulings that interpret chain supplies for different scenarios, influencing VAT policies EU-wide.

- Article 32 sets the general rule for determining the place of supply of goods when they are dispatched or transported. It states that the place of supply is where the goods are located at the time when dispatch or transport to the customer begins, regardless of who carries out the transport (supplier, customer, or third party).

- This article is critical for VAT purposes because it establishes the taxation jurisdiction for cross-border goods movements, impacting the application of VAT rates and compliance requirements.

- However, Article 32 works alongside Article 33, which contains derogations that apply in certain situations of goods dispatched or transported by or on behalf of the supplier between Member States. This distinction often causes complexity in chain supplies.

- Several ECJ cases interpret Article 32 in the context of chain supplies:

- C-245/04 EMAG dealt with how to identify the place of supply in chain transactions,

- C-430/09 Euro Tyre clarified allocation of transport responsibilities,

- C-386/16 Toridas addressed exemption applicability in intra-community supplies within chains,

- C-628/16 Kreuzmayr concerned which supply should be zero-rated in chains.

- The key issue is to avoid double taxation or VAT fraud by clearly attributing transport and supply to a particular Member State and ensuring the VAT chain reflects the economic reality rather than contractual formalities.

- The ECJ emphasizes that Article 32’s wording is intentionally broad to cover transport by any party but must be read in conjunction with Article 33 to identify exceptions such as when transport is “on behalf of the supplier.”

- This distinction is essential to correctly apply VAT rules, prevent abuse, and safeguard the internal market’s fiscal neutrality.

In summary, Article 32 plays a foundational role in VAT law for goods supply chains, clarifying tax jurisdiction and the place of supply to ensure correct VAT application in complex cross-border transactions. ECJ cases have refined its interpretation, balancing the Directive’s goals of preventing tax evasion and ensuring certainty for businesses

Article in the EU VAT Directive

Supply of goods – Place of goods with transport

Article 32

Where goods are dispatched or transported by the supplier, or by the customer, or by a third person, the place of supply shall be deemed to be the place where the goods are located at the time when dispatch or transport of the goods to the customer begins.

However, if dispatch or transport of the goods begins in a third territory or third country, both the place of supply by the importer designated or recognised under Article 201 as liable for payment of VAT and the place of any subsequent supply shall be deemed to be within the Member State of importation of the goods.

ECJ Cases – Decided

- C-245/04 (EMAG Handel Eder OHG) – Place of supply in case of chain supplies

- C-430/09 (Euro Tyre Holding) – Allocation of transport in case of chain supplies

- C-386/16 (Toridas) – Exemption of intra-Community supply of goods in a chain of supplies only applies to the supply to which that transport can be attributed

- C-628/16 (Kreuzmayr ) – Chain supplies; Which supply is zero-rated?

Other ECJ Cases related to ”Chain supplies” not dealing with art.32

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- Commission Backs Italy’s VAT Derogation Through 2028

- Comments on GC T‑575/24 – AG – Contrary to EU law if services provided to members are regarded as internal acts

- Comments on ECJ C-515/24 (Randstad España) – AG – Introduction of exclusion of VAT deduction of representation expenses by Spain not contrary to EU law

- Briefing Document & Podcast: VAT concepts ”Chain Transactions” & ”Triangulation” explained based on ECJ/CJEU cases

- Comments on ECJ C-744/23: No-Cure-No-Pay Services Are Subject to VAT