On October 2, 2025, the ECJ issued it judgment in the case C-86/24 (CS STEEL a.s.).

Context: Reference for a preliminary ruling – Customs union – Regulation (EU) No 952/2013 – Determination of origin of goods – Delegated Regulation (EU) 2015/2446 – Subheading 7304 41 of the Harmonised Commodity Description and Coding System – Tubes, pipes and hollow profiles, seamless, of iron (other than cast iron) or steel – Validity of the rule of origin applicable to steel pipes – Hot-finished pipes, subsequently cold-reduced

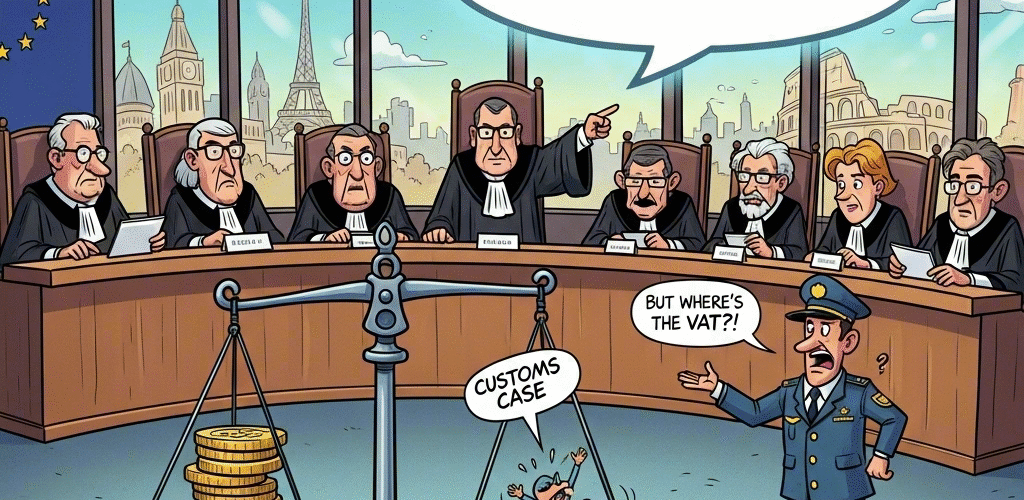

Summary

- Case Overview: The Court addressed a preliminary ruling regarding the validity of the primary rule for determining the origin of seamless steel pipes classified under HS subheading 7304 41, specifically concerning the processing of hot-finished pipes that underwent cold reduction before being imported into the EU.

- Legal Context: The case involves the interpretation of the Customs Code and the Delegated Regulation (EU) 2015/2446, which outlines rules for determining the non-preferential origin of goods, including the criteria for substantial processing necessary to change the origin of goods.

- Dispute Background: CS STEEL, a Czech company, faced a customs duties adjustment after the national customs authority determined that the pipes were of Chinese origin, despite CS STEEL claiming they were of Indian origin after processing in India.

- Court’s Findings: The Court concluded that the primary rule did not discriminate against cold-processed pipes under HS subheading 7304 11 compared to those under subheading 7304 49, affirming that the processing of the former does not confer new origin status as per the established rules.

- Final Ruling: The Court ruled that there was no valid reason to invalidate the primary rule regarding the origin of goods under subheading 7304 41, as the distinction in treatment between the two types of processing was objectively justified and did not represent a manifest error by the Commission.

Questions

Is the primary rule for determining origin set out in subheading 7304 41 of the [HS], as laid down in Annex 22-01 to Delegated Regulation 2015/2446, valid, to the extent that it rules out that cold processing (by cold reduction) is sufficient to change the origin of hot-finished [pipes] under subheading 7304 11 [and] complying with ASTM A312?

Decision

The examination of the question referred for a preliminary ruling has disclosed no factor of such a kind as to affect the validity of the primary rule applicable to goods under subheading 7304 41 of the Harmonised Commodity Description and Coding System, provided for in Annex 22-01 to Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards detailed rules concerning certain provisions of the Union Customs Code.

Source

Comments

- This judgment references to a judgment with a similar topic: Case C‑210/22 (Stappert Deutschland GmbH).

- Case C-210/22 (Stappert Deutschland) concerns hot-formed unfinished tubes (CN 7304 49) from China, further cold-worked (cold-rolling) in South Korea into finished tubes (CN 7304 41). The ECJ decided that the origin may be South Korea, since the rule preventing this was declared invalid. The final determination lies with the national court.

- Case C-86/24 (CS STEEL) concerns tubes under CN 7304 11 from China, further cold-processed in India (cold-rolling, pickling, passivating, etc.) into tubes CN 7304 41. Here the ECJ decides that the origin remains China. The processing in India is not sufficiently substantial to confer a change of origin.

Newsletters

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

Latest Posts in "European Union"

- Recent ECJ/General Court VAT Jurisprudence and Implications for EU Compliance (November 2025)

- Navigating VAT Exemptions: Recent ECJ Judgments and Their Implications for Intra-Community Transactions and Imports

- Review of the VAT treatment of Transfer Pricing adjustments

- EU VAT Rate Changes in 2026: Key Updates for Finland, Lithuania, and Germany

- Amazon Phases Out Commingling: New FNSKU Barcodes Reshape Fulfilment and VAT Compliance