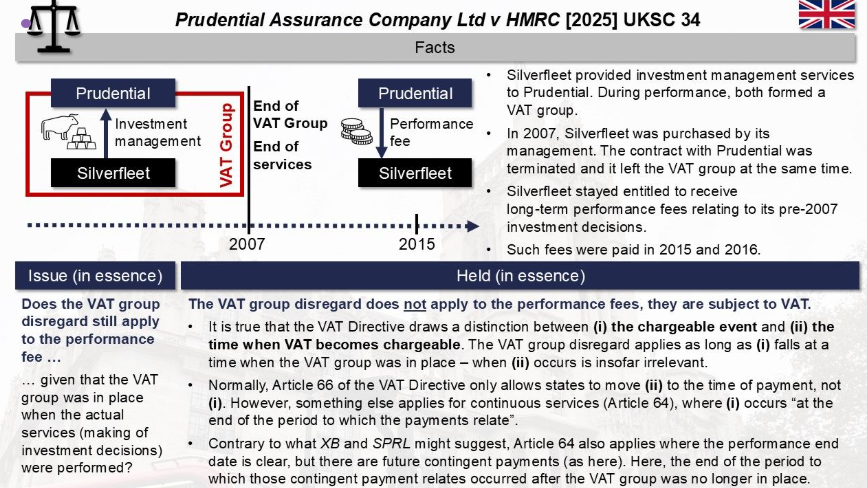

- Supreme Court Ruling: Prudential has lost its appeal in the UK Supreme Court, which upheld the distinction between the chargeable event and when VAT becomes chargeable, countering the previous court’s reliance solely on domestic legislation.

- Importance of Legal Distinctions: The Supreme Court’s decision highlighted the critical need to differentiate between the timing of service performance and the ongoing nature of services under Article 64, preventing potentially anomalous outcomes in VAT treatment.

- Impact on Prudential’s Case: The ruling was ultimately detrimental to Prudential, as the Court determined that services did not lose their “continuous” status merely because their performance had concluded, reinforcing the importance of consistent legal interpretations in VAT matters.

Source Fabian Barth

-

- The Supreme Court in th

-

- e Prudential Assurance case clarified the interaction between VAT grouping and time of supply rules. The Court ruled that the time of supply rules determin

- e when VAT is due, not the VAT grouping rules. This means that if a supplier invoices for success fees after leaving a VAT group, VAT is due on those fees. The decision emphasized that VAT grouping rules do not have separate time of supply rules and are subject to the general time of supply rules. The Supreme Court’s unanimous judgment provided clarity on this issue, rejecting the taxpayer’s argument that regulation 90 only affects when VAT becomes chargeable, not when a chargeable event occurs.

Source: europeantax.blog

Latest Posts in "United Kingdom"

- HMRC Policy paper: Budget 2025 document

- Briefing document & Podcast: E-Invoicing & E-Reporting in the United Kingdom: Scope and Implementation Overview

- Mandatory B2B e-invoicing as of April 2029

- UK Budget 2025: HMRC Eases VAT Rules for UK Businesses with EU Branches

- Budget 2025: Government Bans VAT Loophole for Uber, Bolt and Ride-Hailing Apps