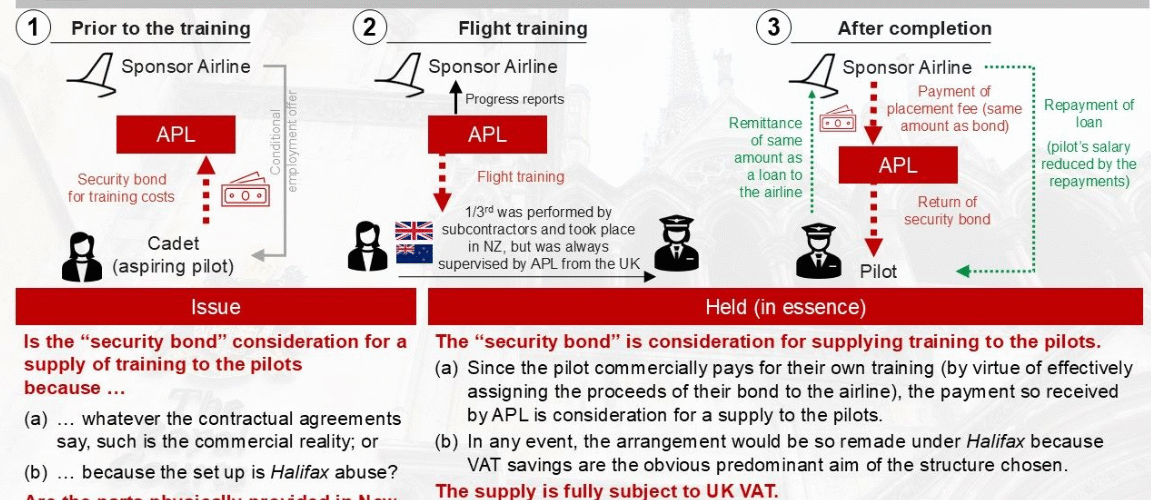

- Case Overview: The dispute centered around whether APL, a provider of pilot training, made a taxable B2B supply to airlines or a B2C supply to the pilots receiving training. The tribunal found that, despite the contractual arrangement, the pilots effectively paid for their own training through salary reductions linked to a bond agreement with the airline.

- Key Findings: The tribunal concluded that the economic reality differed from the contractual terms, as pilots were indirectly financing their training via salary deductions, thus recognizing them as the actual recipients of APL’s services for VAT purposes.

- Place of Supply Considerations: While the tribunal’s decision on place of supply raised questions due to the presence of APL’s subcontractors in New Zealand, this point was ultimately rendered moot as HMRC had previously conceded it under a separate agreement, ensuring that the case’s outcome was not affected.

Source Fabian Barth

Latest Posts in "United Kingdom"

- UK VAT Gap Rises to £11.9bn in 2024–25, HMRC Reports 6.5% Shortfall

- Luzha v HMRC: VAT Late Submission Penalties Upheld, No Reasonable Excuse Found, Appeal Dismissed

- VAT Repayment Appeal: Validity of Invoices and Alternative Evidence under Regulation 29(2) Considered

- Tribunal Upholds VAT Assessment: Cattle Management Services Deemed Single Standard-Rated Supply, Appeal Dismissed

- UK Supreme Court Rules Input VAT on Share Sale Professional Fees Irrecoverable for Holding Companies