- The law effective from January 1, 2025, changes the VAT application for landfill and incineration without energy recovery.

- The reduced VAT rate of 10 percent no longer applies to these services.

- The Association seeks clarification on the correct VAT rate for services invoiced after January 1, 2025, but performed before December 31, 2024.

- The Agency clarifies that the ordinary VAT rate applies to services paid from January 1, 2025, regardless of when they were performed.

- The absence of transitional provisions means the timing of payment determines the applicable VAT rate.

Source: agenziaentrate.gov.it

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Italy"

- Right to Refund of Undue VAT on Provincial Surcharge for Electricity Declared Unconstitutional

- Active and Complied Installment Plan Excludes Punishment for Omitted VAT Payment Under New Law

- VAT Exemption Also Applies to Claims Management Services, Supreme Court Rules

- VAT Exemption Also Applies to Claims Management Services, Rules Italian Supreme Court

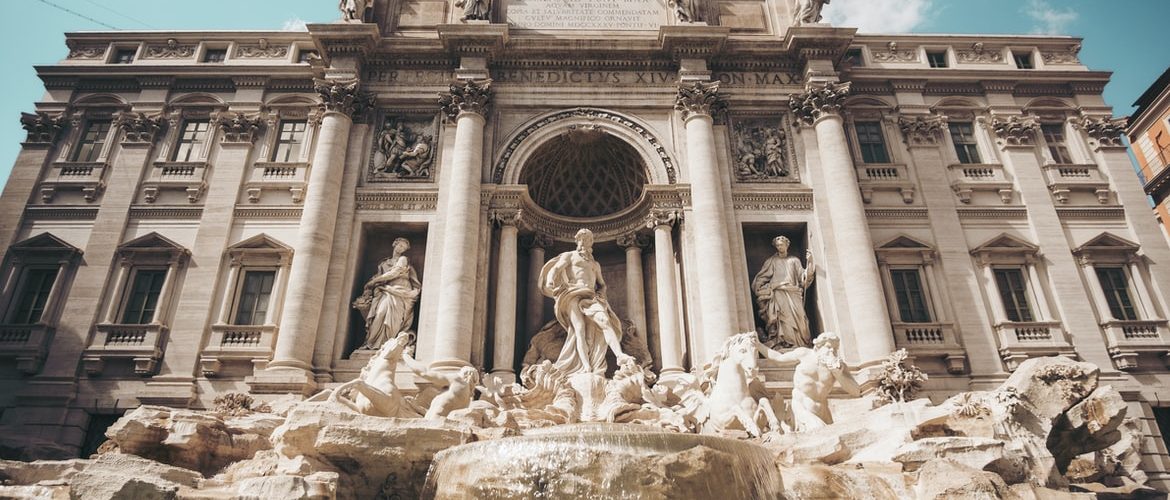

- Italy Proposes Rome as Host City for New EU Customs Authority Headquarters