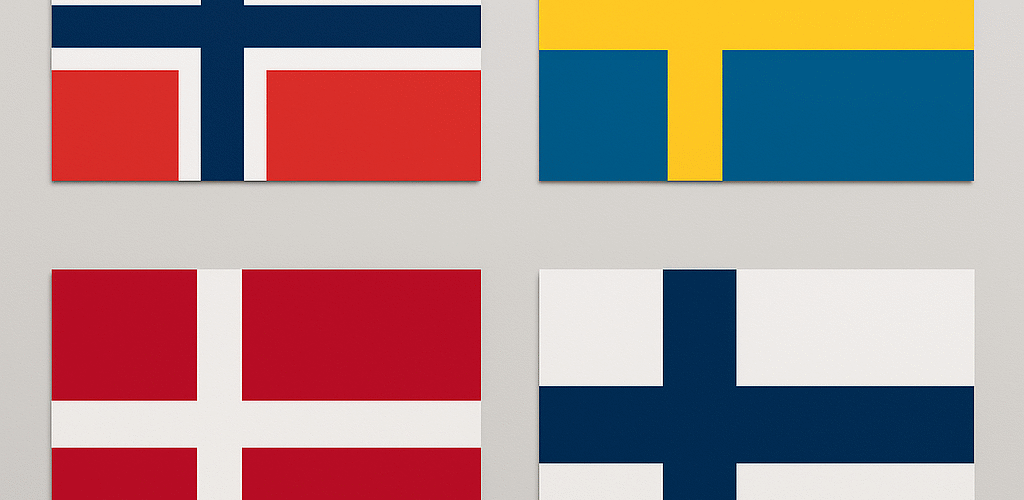

- Transition to Mandatory e-Invoicing: Denmark, Sweden, and Norway are moving towards mandatory e-invoicing for B2B transactions, driven by the EU’s ViDA initiative, which requires all member states to implement e-invoicing and transaction-based reporting for cross-border transactions by July 1, 2030. Denmark has already established a robust framework, while Sweden and Norway are in the process of legislative consultations to comply with these requirements.

- National Systems and Compliance Standards: Denmark’s e-invoicing infrastructure, established through the Bookkeeping Act, mandates businesses to use structured e-invoices compliant with the Peppol BIS 3.0 format by specified deadlines. In Sweden, the Tax Agency has announced plans to implement mandatory e-invoicing and real-time reporting, targeting compliance with EU standards. Norway is also proposing amendments to its Accounting Act to require structured e-invoices via the Peppol network by 2028, with a phased implementation for all businesses.

- Impact on Business Operations: The transition to e-invoicing is expected to streamline invoice processing, enhance compliance with VAT regulations, and reduce fraud. Businesses in all three countries will need to adopt certified digital systems capable of creating, sending, and storing e-invoices in compliance with the EN 16931 standard. This shift will significantly change how companies manage invoicing, especially in intra-EU transactions, making e-invoicing the standard method of operation.

Source eezi – Powered by VAT IT

- See also

- Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE

Latest Posts in "Denmark"

- Denmark Plans 2028 VAT Cut on Food to Ease Prices and Promote Healthier Diets

- VAT Applies to Gospel Choir Teaching; Not Exempt as School, Vocational, or Cultural Activity

- Tax Authority Will Not Reduce Repayment Claims by Suppliers’ Savings After ATP PensionService Ruling

- Extraordinary Change of VAT Liability Due to Gross Negligence in Reporting and Calculation Methods

- Briefing Document & Podcast: E-Invoicing and E-Reporting in Denmark