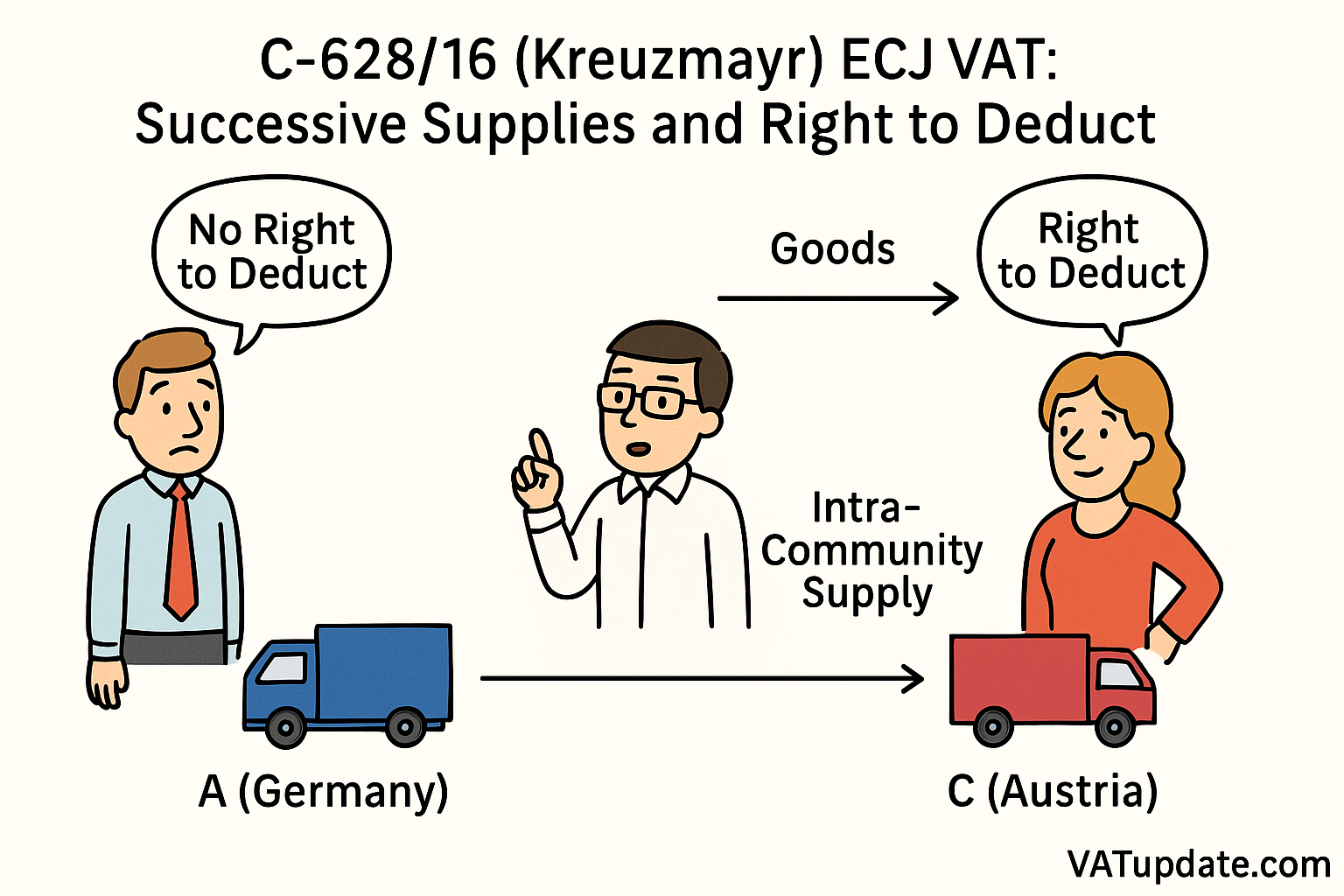

Briefing Doc: VAT Deduction in EU Chain Transactions – The Kreuzmayr Case

This briefing document reviews the key themes, important ideas, and facts stemming from the provided sources concerning VAT deduction and intra-Community supplies, particularly in the context of successive chain transactions. It draws heavily on the judgment of the Court of Justice of the European Union (CJEU) in the Kreuzmayr GmbH v. Finanzamt Linz case (C‑628/16, ECLI:EU:C:2018:84), alongside supplementary study guide materials.

I. Core Legal Framework and Principles

The case revolves around the application and interpretation of several key EU and national VAT provisions and principles:

- VAT Directive (Council Directive 2006/112/EC): This is the primary EU law for the common VAT system.

- Article 32 (First Paragraph): Crucially, this article defines the “place of supply” for goods that are dispatched or transported. It stipulates that “the place of supply shall be deemed to be the place where the goods are located at the time when dispatch or transport of the goods to the customer begins.” This provision is central to determining which Member State’s VAT rules apply.

- Article 138(1): Exempts intra-Community supplies of goods from VAT under specific conditions, meaning they are not subject to VAT in the Member State of dispatch.

- Article 167 & 168(a): Govern the “right to deduct input VAT,” stating that this right arises when the deductible tax becomes chargeable and allows taxable persons to deduct VAT paid on goods and services used for their taxed transactions.

- Umsatzsteuergesetz 1994 (UStG 1994 – Austrian Law on turnover tax): The relevant national Austrian law, which largely aligns with the VAT Directive. Notably, Paragraph 12(1) Point 1 includes a provision that “the right to deduct input tax shall lapse” if the trader “knew or must have known that the transaction in question related to VAT evasion or other financial crimes relating to VAT,” even if upstream or downstream.

- Intra-Community Supply: Defined as the supply of goods transported between different EU Member States for another taxable person, generally exempt from VAT in the Member State of dispatch.

- Right to Deduct Input VAT: A fundamental principle ensuring “VAT neutrality” by relieving traders of the VAT burden on their inputs, allowing them to reclaim VAT paid on purchases for their economic activities. The burden ultimately falls on the final consumer.

- Successive Supplies / Chain Transactions: A common scenario where the same goods are sold multiple times but undergo only a single physical transport within the EU.

- Protection of Legitimate Expectations: A general principle of EU law, which applies when an “administrative authority has caused that person to entertain expectations which are justified by precise assurances provided to him.” This principle dictates that individuals should not be negatively affected if they reasonably relied on clear administrative guidance.

II. Case Background: Kreuzmayr GmbH v. Finanzamt Linz

The Kreuzmayr case illustrates the complexities of VAT treatment in chain transactions:

- Parties Involved:BP Marketing GmbH (X1): A German VAT-registered company, the initial supplier of petroleum products.

- BIDI Ltd (X2): An Austrian VAT-registered company, acting as the intermediary operator.

- Kreuzmayr GmbH (X3): An Austrian company, the final recipient of the products.

- Finanzamt Linz: The Linz Tax Office in Austria.

- Transaction Flow:X1 (BP Marketing, Germany) to X2 (BIDI, Austria): BP Marketing sold petroleum products to BIDI. BIDI indicated its intention to transport the goods to Austria and provided its Austrian VAT identification number. BP Marketing classified this as an exempt intra-Community supply.

- X2 (BIDI, Austria) to X3 (Kreuzmayr, Austria): Critically, BIDI resold the same goods to Kreuzmayr before the goods were physically transported from Germany to Austria. Kreuzmayr then took responsibility for arranging and carrying out the transport from Germany to Austria.

- VAT Dispute:Kreuzmayr received invoices from BIDI that included Austrian VAT, which Kreuzmayr paid and subsequently deducted as input VAT in 2008.

- However, BIDI failed to declare or pay this invoiced VAT to the Austrian authorities, arguing its supply to Kreuzmayr was an exempt intra-Community supply, taxable in Germany.

- The Linz Tax Office, upon audit, initially allowed Kreuzmayr’s deduction but later cancelled it, contending that the supply between BIDI and Kreuzmayr was not in Austria and thus no Austrian VAT was due for deduction.

- Path to CJEU: After a series of national court decisions, the Bundesfinanzgericht (Federal Finance Court, Austria) referred three questions to the CJEU for a preliminary ruling, primarily concerning the determination of the “moving supply” in a chain transaction and the applicability of the principle of legitimate expectations.

III. CJEU’s Analysis and Rulings

The CJEU’s judgment provided definitive interpretations for such scenarios:

- Question 1: Which supply does the single intra-Community transport apply to (X1-X2 or X2-X3)?Principle: The Court reiterated that where “two successive supplies of the same goods… give rise to a single intra-Community transport… that transport can be ascribed to only one of the two supplies.” Determining which supply the transport is ascribed to requires “an overall assessment of all the specific circumstances of the case,” with particular attention to “when the second transfer of the right to dispose of the goods as owner, to the person finally acquiring the goods, has taken place.”

- Finding & Ruling: The Court found that “Kreuzmayr was the owner of the goods before the intra-Community transport took place.” Therefore, the intra-Community transport was ascribed to the second supply (BIDI to Kreuzmayr). This meant the supply from BIDI to Kreuzmayr was the intra-Community supply and thus exempt from VAT in Austria. The first paragraph of Article 32 of the VAT Directive thus applies to the second supply.

- Crucial Implication: The classification by the first supplier (BP Marketing) and the VAT identification number provided by the intermediary (BIDI) were not decisive if objective evidence (like the transfer of ownership to X3 before transport) contradicted that classification.

- Question 2: Can Kreuzmayr still deduct input VAT if the invoice was incorrect, based on legitimate expectations?Principle: The “right to deduct VAT can be exercised only in respect of taxes actually due and cannot be extended to overpaid input VAT.” The Court stated that “the exercise of that right does not extend to VAT which is due exclusively because it features on an invoice.”

- Legitimate Expectations: The principle of legitimate expectations applies when “an administrative authority has caused that person to entertain expectations which are justified by precise assurances provided to him.” It “cannot be relied on against his supplier” in this context.

- Finding & Ruling: Since the supply from BIDI to Kreuzmayr was an exempt intra-Community supply, no Austrian VAT was legally due. Therefore, Kreuzmayr could not deduct the VAT amount incorrectly charged by BIDI. Kreuzmayr’s reliance on BIDI’s incorrect invoice (a private party) did not invoke the principle of legitimate expectations.

- Question 3: The Court did not need to answer this question due to its clear ruling on Question 1.

IV. Implications of the Judgment

The Kreuzmayr judgment carries significant implications for businesses engaged in intra-Community chain transactions:

- Clarity on “Moving Supply”: It provides definitive guidance that in chain transactions with a single intra-Community transport, the transport is attributed to the supply where the right to dispose of the goods as owner is transferred to the final acquirer before the transport begins. This underscores the importance of the timing of ownership transfer.

- Due Diligence for Intermediaries and Acquirers: The case highlights that operators cannot solely rely on the classification or information provided by the initial supplier if they possess objective evidence indicating a different VAT treatment. Both intermediary operators and final acquirers must exercise due diligence to ensure correct VAT classification, especially when they arrange or carry out the transport.

- Strict Application of Right to Deduct: The ruling reinforces that the right to deduct input VAT is contingent upon the tax being “actually due.” Incorrect invoicing by a supplier does not create a valid right to deduct if the underlying transaction is exempt or not taxable in that Member State. This upholds the principle of VAT neutrality by ensuring only legitimate VAT amounts are deducted.

- Limits of Legitimate Expectation Principle: It clearly distinguishes between assurances from administrative authorities (where legitimate expectation can apply) and misleading information from private parties (where it does not). This means businesses cannot claim a right to deduct based on incorrect invoices from their suppliers.

- Recourse for Overpaid VAT: If VAT is wrongly paid due to an incorrect invoice, the recourse for the overpaid amount lies with the invoicing supplier, not the tax authorities via deduction. The final recipient must seek repayment from the supplier under national law. This was the suggested recourse for Kreuzmayr in its situation with BIDI.

See also

- ECJ – C-628/16 (Kreuzmayer) – Judgment – Chain transactions – VAT treatment of intra-Community supply of goods – VATupdate

- Briefing Document & Podcast: VAT concept ”Chain Transactions” explained based on ECJ/CJEU cases – VATupdate

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- VAT IOSS Scheme: Intermediary Registration Available from April 2026 for Non-EU Businesses

- Customs and VAT Fraud Cost EU €45 Billion in 2025, Officials Warn

- EPPO Investigates Record 3,600 Customs Fraud Cases in 2025, Damages Reach 67 Billion Euros

- Intermediary Registration for UK Import One Stop Shop Scheme Opens April 2026

- EPPO Uncovers €45 Billion VAT and Customs Fraud, Reshaping EU Criminal Landscape in 2025