Briefing Document: ECJ Case C-802/19 (Firma Z v Finanzamt Y) – VAT, Discounts, and Cross-Border Medical Supplies

1. Executive Summary

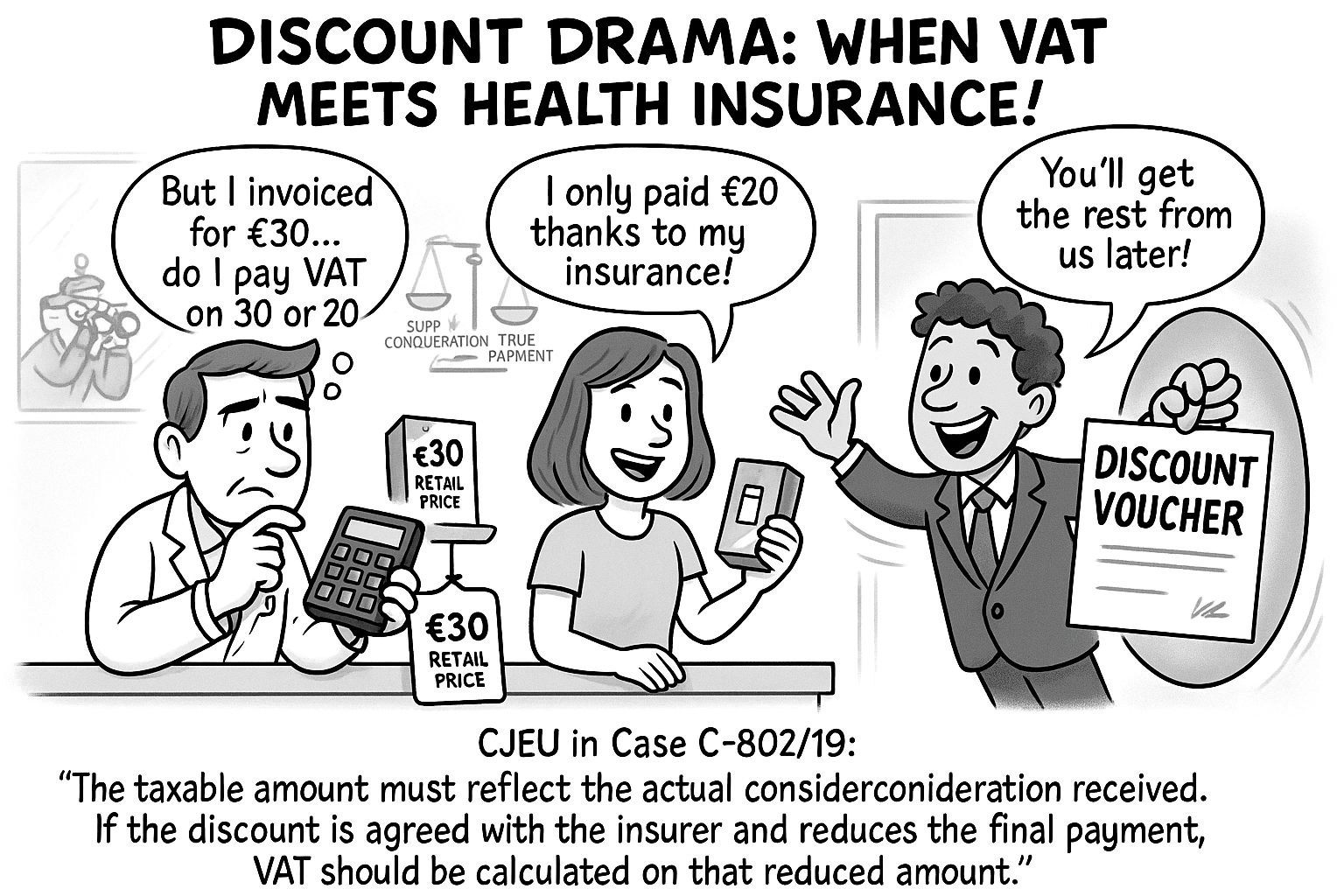

The European Court of Justice (ECJ) Case C-802/19, involving Firma Z and Finanzamt Y, clarified the application of Article 90(1) of Council Directive 2006/112/EC (the VAT Directive) regarding the reduction of the taxable amount for Value Added Tax (VAT) purposes. The core issue was whether a pharmacy (Firma Z) making VAT-exempt intra-Community supplies of medicinal products could reduce its taxable amount in another Member State by granting discounts to final consumers. The Court ruled that no reduction of the taxable amount is possible for VAT-exempt supplies, as there is no initial taxable amount to adjust. This judgment underscores that the “Elida Gibbs principle” – allowing for VAT reduction in certain discount scenarios – is only applicable where an initial taxable transaction exists.

2. Parties and Background

- Firma Z: A pharmacy operating by mail order from the Netherlands, supplying prescription-only medicinal products to Germany.

- Finanzamt Y (Tax Office Y, Germany): The German tax authority challenging Firma Z’s VAT claims.

- Dispute: Firma Z granted “compensation” (discounts) to its German customers, including those covered by statutory health insurance. It sought to reduce its German VAT taxable amount, particularly for supplies to privately insured persons, arguing that the compensation given to statutorily insured persons should lead to such a reduction. The Tax Office issued an additional assessment, which was upheld by the Finanzgericht (Finance Court, Germany).

3. Legal Framework and Central Questions

The case primarily revolved around the interpretation of Article 90(1) of Council Directive 2006/112/EC. This article states: “In the case of cancellation, refusal or total or partial non-payment, or where the price is reduced after the supply takes place, the taxable amount shall be reduced accordingly under conditions which shall be determined by the Member States.”

Firma Z’s arguments were based on:

- Paragraph 17(1) of the German Umsatzsteuergesetz (UStG).

- The “Elida Gibbs principle” (from ECJ Case C-317/94), which generally allows for a reduction of the taxable amount when a manufacturer (first link in a chain) grants a price reduction to the final consumer, even without direct contractual relationship, to ensure VAT neutrality.

The Bundesfinanzhof (Federal Finance Court, Germany) referred two questions to the ECJ:

- Whether a pharmacy supplying medicinal products to a statutory health insurance fund is entitled to reduce the taxable amount due to a discount granted to the insured persons, based on the Elida Gibbs judgment.

- If so, whether it would contradict the principles of neutrality and equal treatment if a German pharmacy could reduce the taxable amount but a pharmacy supplying from another Member State via an intra-Community, tax-exempt supply could not.

4. Key Factual Distinctions in Firma Z’s Operations

Firma Z engaged in two distinct types of medicinal product supplies:

- Supplies to privately insured individuals: Firma Z considered these direct sales, taxable in Germany, and sought to reduce the taxable amount based on compensation paid. This aspect was not the primary subject of the dispute before the ECJ.

- Supplies to statutorily insured individuals: For these, Firma Z first settled with German statutory health insurance funds. The compensation was then offset against the insured person’s share of the medicinal product’s cost. Firma Z considered these intra-Community, VAT-exempt supplies in the Netherlands (under Article 138(1) of Directive 2006/112/EC). Crucially, the statutory health insurance funds (as legal persons) were required to pay VAT on the acquisition in Germany. The “second supply” from the statutory health insurance fund to the insured person was noted as falling outside the scope of VAT under Article 2(1)(a) of Directive 2006/112.

The core of the dispute focused on whether discounts granted to statutorily insured persons could lead to a reduction in Firma Z’s taxable amount, specifically in relation to its other (taxable) supplies.

5. Admissibility of the Request for Preliminary Ruling

The German Government argued the request was inadmissible, claiming the questions were irrelevant and hypothetical because Firma Z’s intra-Community supplies were VAT-exempt in the Netherlands, meaning no taxable amount existed for reduction under Article 90(1).

The ECJ deemed the request admissible. It upheld the presumption of relevance for questions concerning EU law, stating that it would only refuse a ruling if “it is quite obvious that the interpretation of EU law that is sought bears no relation to the actual facts of the main action or its subject matter, where the problem is hypothetical, or where the Court does not have before it the factual or legal material necessary to give a useful answer.” The Court found that the referring court had “adequately and precisely set out the facts giving rise to the main proceedings and the legal background thereof, from which it is apparent that the questions referred are not hypothetical.” It also reiterated that the assessment of facts and interpretation of national law are solely for the national court.

6. Court’s Ruling and Reasoning on the First Question

The ECJ answered the first question in the negative, concluding that Firma Z could not reduce its taxable amount.

The Court’s reasoning was straightforward and fundamental to VAT principles:

- Absence of a Taxable Amount: The supplies of pharmaceutical products by Firma Z to the statutory health insurance fund were VAT-exempt in the Netherlands (the Member State of dispatch) under Article 138(1) of Directive 2006/112/EC.

- Conditions for Article 90(1) Not Met: “In so far as Firma Z does not have a taxable amount capable of being adjusted, it must be held that the conditions for applying Article 90(1) of Directive 2006/112 are not fulfilled” (Paragraph 43). Article 90(1) presupposes an initial taxable amount that can be reduced.

- “Elida Gibbs Principle” Irrelevance: The Court explicitly stated that an examination of the “chain of transactions” or the Elida Gibbs principle was unnecessary because the primary condition – the existence of a taxable amount for Firma Z – was not met (Paragraph 47). The Elida Gibbs principle allows for a reduction of an existing taxable amount.

- No Offsetting Between Transactions: The Court also rejected the idea of “offsetting the reduction to the taxable amount for one transaction when calculating the taxable amount for another transaction,” stating this “is precluded under the common VAT system” (Paragraph 44). This directly addressed Firma Z’s attempt to reduce the taxable amount for supplies to privately insured persons based on discounts given to statutorily insured persons.

7. Conclusion

The Court’s final judgment stated: “Article 90(1) of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax must be interpreted as meaning that a pharmacy established in one Member State may not reduce its taxable amount where it carries out intra-Community supplies of pharmaceutical products, those supplies being exempt from value added tax in that Member State, to a statutory health insurance fund established in another Member State and it grants a discount to those persons covered by that insurance.”

8. Broader Implications

This ruling clarifies that the right to reduce the VAT taxable amount under Article 90(1) of the VAT Directive is contingent upon the initial supply being taxable for the supplier. If a supply is VAT-exempt for the supplier in the Member State of dispatch, there is no taxable amount to reduce, regardless of any subsequent discounts or the existence of a “chain of transactions” involving a final consumer.

The judgment reinforces the principle that VAT adjustments must relate to an existing, taxed value. It highlights the critical importance for businesses engaged in cross-border transactions to accurately determine the VAT treatment of their supplies in the Member State of dispatch, as this directly impacts any potential for subsequent reductions in the taxable amount. The principle of VAT neutrality applies within the context of taxable transactions and does not create a right to a reduction where the initial supply itself is exempt.

See also

- ECJ C-802/19 (Firma Z) – Judgment – Adjustments of taxable amount; domestic and intra-Community supplies of medicinal products; discounts under health insurance scheme – VATupdate

- Roadtrip through ECJ Cases – Focus on the Exemption for Intra-Community supplies of goods (Art. 138) – VATupdate

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- ECJ VAT C-409/24 to C-411/24 – Judgment – Reduced VAT Rate Excludes Non-Accommodation Ancillary Services

- ECJ C-436/24 (Lyko Operations) – Judgment – Loyalty Points in Customer Reward Schemes Are Not VAT Vouchers

- ECJ C-472/24 (Žaidimų valiuta) – Judgment – VAT Exemption Denied for Virtual Money Transactions

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027