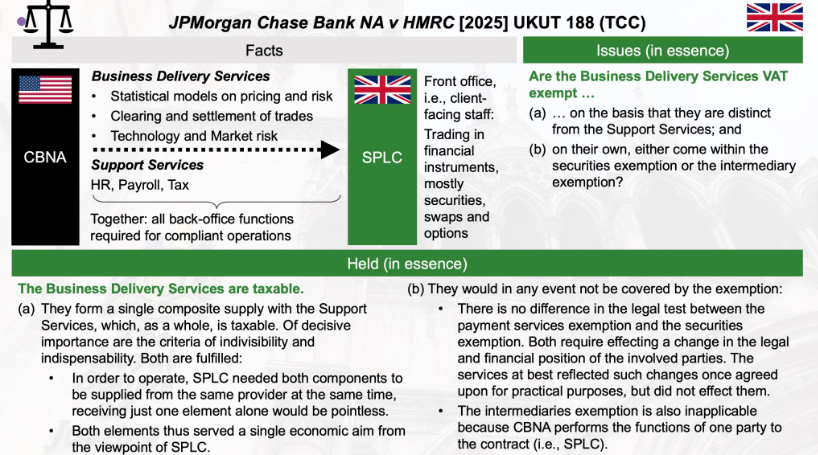

- Risk of Exceeding Exemptions: The complexity and broad scope of outsourced services, such as those in the JPMorgan Chase case in the UK, increase the likelihood that they may exceed the boundaries of available exemptions or reduced tax rates.

- Single Supply Concept: The Upper Tribunal’s reasoning suggests that an entire outsourced back office function should be viewed as a single supply, highlighting the challenges of coordinating services from multiple non-connected providers to meet various economic demands.

- Taxable Elements and Exemptions: While the Tribunal concluded that the Business Delivery Services contained no exempt elements, there are plausible taxable components, such as risk assessments, indicating that some aspects may impact legal and financial positions beyond mere contractual rights.

Source

JPMorgan Chase Bank, NA – UT– Intra-group bought in services – whether exempt – no – s43(2A) – taxpayer loss

- Tribunal Decision: The Upper Tribunal dismissed JPMorgan Chase Bank’s appeal, confirming that the intra-group services provided under the Global Master Services Agreement (GMSA) constituted a single composite supply of taxable “Support Services,” rather than separate exempt services, following the First-tier Tribunal’s interpretation of the contractual arrangements.

- Exemption Analysis: The UT also addressed the application of the securities exemption, stating that the services provided did not meet the criteria for exemption under Item 6 of Group 5, Schedule 9 of the VAT Act. It emphasized that the operational necessity of services does not equate to altering the legal and financial relationships necessary for exemption.

- Implications for Businesses: The ruling raises concerns for large international businesses using umbrella agreements, suggesting that merely updating contracts without substantial changes to the services may not suffice for distinct VAT treatments. Businesses are advised to review their intra-group service arrangements and documentation practices to ensure compliance and proper reflection of VAT treatments in their contracts.

To access the decision, click here.

Source KPMG

Latest Posts in "United Kingdom"

- VAT Beginner’s Guide: Essential Basics for UK Business Registration and Rates

- When Do You Have to Charge Yourself VAT? Key Situations Explained

- Supreme Court Clarifies VAT Group Rules and Time of Supply Interplay

- Isle of Wight NHS Trust vs HMRC: VAT Exemption Dispute on Locum Medical Practitioners

- HMRC Guidance: How to correct VAT errors and make adjustments or claims (VAT Notice 700/45)