EU VAT Directive: Taxable Persons Briefing Document

This briefing document provides a detailed overview of the concept of a ‘taxable person’ under EU VAT Law, drawing from the EU VAT Directive 2006/112/EC (hereafter “the Directive”). Understanding who qualifies as a taxable person is fundamental to determining VAT obligations and rights within the European Union.

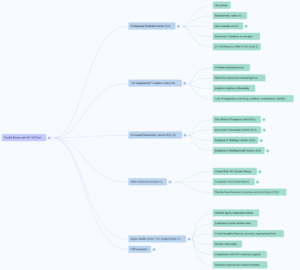

I. Fundamental Definition of a Taxable Person

The core definition of a ‘taxable person’ is laid out in Article 9(1) of the EU VAT Directive. It states that a taxable person is “any person who, independently, carries out in any place any economic activity, whatever the purpose or results of that activity.”

This definition hinges on two critical elements:

- Independence: The activity must be carried out independently, not under an employment contract or similar legal ties.

- Economic Activity: The activity must be economic in nature, broadly interpreted to include a wide range of income-generating pursuits.

II. The Concept of ‘Economic Activity’

‘Economic activity’ under the Directive is a broad concept, encompassing more than just traditional business operations. As per Article 9(1):

- It explicitly includes “Any activity of producers, traders or persons supplying services, including mining and agricultural activities and activities of the professions.”

- Crucially, “The exploitation of tangible or intangible property for the purposes of obtaining income therefrom on a continuing basis shall in particular be regarded as an economic activity.” This ensures a wide array of income-generating pursuits fall within the scope of VAT, regardless of their specific nature or the results achieved.

III. The ‘Independently’ Condition and Employed Persons

The condition that economic activity must be conducted ‘independently’ is crucial for distinguishing between employees and self-employed individuals for VAT purposes. Article 10 clarifies that this condition “shall exclude employed and other persons from VAT in so far as they are bound to an employer by a contract of employment or by any other legal ties creating the relationship of employer and employee as regards working conditions, remuneration and the employer’s liability.” This distinction is vital because employees lack the necessary independence to be considered taxable persons for the activities performed under their employment contract.

IV. Occasional Transactions Leading to Taxable Person Status

While VAT generally applies to regular economic activities, there are specific instances where occasional transactions can trigger taxable person status, thus broadening the scope of VAT liability.

- New Means of Transport: Article 9(2) states that “any person who, on an occasional basis, supplies a new means of transport, which is dispatched or transported to the customer by the vendor or the customer, or on behalf of the vendor or the customer, to a destination outside the territory of a Member State but within the territory of the Community, shall be regarded as a taxable person.” This covers transactions involving vehicles or vessels meeting specific age/mileage criteria.

- Real Estate Transactions: Article 12(1) allows Member States to regard as taxable persons individuals who, on an occasional basis, carry out specific transactions related to economic activities, notably:

- (a) “the supply, before first occupation, of a building or parts of a building and of the land on which the building stands.”

- (b) “the supply of building land.”

- Definition of ‘Building’: For the purpose of Article 12(1)(a), Article 12(2) defines ‘building’ as “any structure fixed to or in the ground.” Member States can establish detailed rules for applying this criterion to building conversions and determine what constitutes ‘the land on which a building stands’.

- Definition of ‘Building Land’: For the purpose of Article 12(1)(b), Article 12(3) defines ‘building land’ as “any unimproved or improved land defined as such by the Member States.”

V. Public Authorities as Taxable Persons

The treatment of public authorities under EU VAT law involves specific considerations to balance public service and fair competition. Article 13(1) outlines the general rule and crucial exceptions:

- General Rule (Non-Taxable): “States, regional and local government authorities and other bodies governed by public law shall not be regarded as taxable persons in respect of the activities or transactions in which they engage as public authorities, even where they collect dues, fees, contributions or payments in connection with those activities or transactions.”

- Exceptions (Taxable): Public authorities are considered taxable persons in the following scenarios:

-

- Distortions of Competition: “where their treatment as non-taxable persons would lead to significant distortions of competition” with private businesses. The rationale here is to prevent public bodies from gaining an unfair competitive advantage due to their non-taxable status.

- Specific Activities: “In any event, bodies governed by public law shall be regarded as taxable persons in respect of the activities listed in Annex I, provided that those activities are not carried out on such a small scale as to be negligible.” These are activities generally performed by private businesses, and their inclusion ensures a level playing field.

- Member State Discretion: Article 13(2) allows Member States to classify certain otherwise exempt activities engaged in by public bodies as “public authority activities,” thereby keeping them outside the scope of VAT.

VI. Single Taxable Person (VAT Group)

Article 11 provides Member States with the option to treat multiple legally independent entities as a ‘single taxable person’ for VAT purposes, commonly referred to as a VAT group.

- Conditions: This is permissible if the persons “are established in the territory of that Member State who, while legally independent, are closely bound to one another by financial, economic and organisational links.”

- Consultation Requirement: Before exercising this option, Member States “may consult the advisory committee on value added tax (hereafter, the ‘VAT Committee’).” The VAT Committee plays a significant advisory role in ensuring harmonisation and oversight.

- Safeguards: Member States exercising this option “may adopt any measures needed to prevent tax evasion or avoidance through the use of this provision.”

This comprehensive understanding of ‘taxable persons’ is essential for compliance and effective operation within the EU VAT framework.

See also – in this serie

TITLE III

TAXABLE PERSONS

Article 9

1.

Any activity of producers, traders or persons supplying services, including mining and agricultural activities and activities of the professions, shall be regarded as ‘economic activity’. The exploitation of tangible or intangible property for the purposes of obtaining income therefrom on a continuing basis shall in particular be regarded as an economic activity.

2.

Article 10

The condition in Article 9(1) that the economic activity be conducted ‘independently’ shall exclude employed and other persons from VAT in so far as they are bound to an employer by a contract of employment or by any other legal ties creating the relationship of employer and employee as regards working conditions, remuneration and the employer’s liability.

Article 11

After consulting the advisory committee on value added tax (hereafter, the ‘VAT Committee’), each Member State may regard as a single taxable person any persons established in the territory of that Member State who, while legally independent, are closely bound to one another by financial, economic and organisational links.

A Member State exercising the option provided for in the first paragraph, may adopt any measures needed to prevent tax evasion or avoidance through the use of this provision.

Article 12

1.

Member States may regard as a taxable person anyone who carries out, on an occasional basis, a transaction relating to the activities referred to in the second subparagraph of Article 9(1) and in particular one of the following transactions:

the supply, before first occupation, of a building or parts of a building and of the land on which the building stands;

the supply of building land.

2.

Member States may lay down the detailed rules for applying the criterion referred to in paragraph 1(a) to conversions of buildings and may determine what is meant by ‘the land on which a building stands’.

Member States may apply criteria other than that of first occupation, such as the period elapsing between the date of completion of the building and the date of first supply, or the period elapsing between the date of first occupation and the date of subsequent supply, provided that those periods do not exceed five years and two years respectively.

3.

Article 13

1.

However, when they engage in such activities or transactions, they shall be regarded as taxable persons in respect of those activities or transactions where their treatment as non-taxable persons would lead to significant distortions of competition.

In any event, bodies governed by public law shall be regarded as taxable persons in respect of the activities listed in Annex I, provided that those activities are not carried out on such a small scale as to be negligible.

2.

Latest Posts in "European Union"

- Comments on ECJ Case C-639/24: Limits on Denying VAT Exemption for Intra-Community Supplies

- European Parliament Analysis: The Role of the Reverse Charge Mechanism in Tackling VAT Fraud

- Mathez Formation: VAT news: the CJEU puts economic reality back at the centre of the game (Feb 6)

- Blog: Navigating Indirect Rebates: A Call for Clarity in VAT Regulations Under ViDA

- Briefing document & Podcast: ECJ C-462/16 – Boehringer Ingelheim Pharma GmbH & Co. KG – Discounts reduce the VAT value of pharmaceutical supplies